What Is The Due Date For An Llc Tax Return

LLC members who must make estimated tax payments on their share of income should pay them four times a year. For example a corporation with a year-end date of December 31 must file and pay taxes by April 15.

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

Corporate tax returns are due and taxes are payable on the 15th day of the fourth month after the end of the companys fiscal or financial year.

What is the due date for an llc tax return. Tax extension requests are due by this date. If you are the only owner of your LLC it is considered a disregarded entity. Whichever accounting method you use the taxes are due on the 15th day of the fourth month after your tax year ends.

Original return or 6-month extension due date. 13 rows 15th day of the third month after the end of the tax year for most Form 1120 corporation. What type of return should a single-member LLC disregarded entity file with Delaware.

For example a corporation with a year-end date of December 31 must file and pay taxes by April 15. Extended due date of Form 1065. April 15 is also the deadline to file for an extension to file your corporate tax return.

However if your businesss fiscal year ends on June 30 you must file Form 1120 by the 15th day of the third month. C corporations in Texas Oklahoma and Louisiana have until June 15 to submit their tax returns. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.

You form a new LLC and register with SOS on June 18 2020. Tax Return Due Dates for C Corporation and Partnership Returns Partnership Tax Returns. Filing Form 7004 for Business Tax Return Extensions.

Partnership tax returns that use Form 1065 for filing the returns must be filed by the 15th day of the third month after the tax year-end date. Today is the deadline to file C corporation tax returns Form 1120. Except for 1099-MISC electronic filing of Forms 1099 and 1098 is due March 31.

The due date for Single-member LLC returns on Schedule C is 17th April 2019 and the due date for partnership returns with Schedule K-1s is 15th March 2019. Filing an amended business tax return should be done as soon as you discover the error. 4 rows Due date.

Single member LLCs in Kentucky are required to file Form 725 Kentucky Single Member LLC Individually Owned Income and LLET Return. 15th day of the 3rd month after the close of your tax year. However business owners must pay any estimated taxes by the original deadline to avoid interest and penalties on overdue tax payments.

The due dates for 2020 are on April 15th June 15th September 15th and January 15th 2020 on a calendar tax year. You must estimate and. Corporation tax returns are generally due on the 15th day of the fourth month after the end of the companys financial year.

Your annual LLC tax will be due on September 15 2020 15th day of the 4th month. Normally it is April 15 but the IRS extends it to the 18th. April 18 is the general deadline for individual tax returns for Forms 1040 1040EZ and 1040A.

The penalty for failure to file by the due date is a percentage of the tax due with a minimum penalty of 10. In general the IRS says you must file within three years from the date you filed your original returnor with two years from the date you paid the tax whichever is later. Partnership tax returns Form 1065 must be filed by the 15th day of the third month after the tax year-end date.

Return of Partnership Income IRS Form 1065 for the LLC and each partner must report their own share of the profits and losses on their own personal tax returns. Generally an election specifying an LLCs classification cannot take effect more than 75 days prior to the date the election is filed nor can it take effect later than 12 months after the date. Extension for Single-member LLCs is until 15th October 2019 filed along with personal tax return and the extension deadline for partnership is 17th September 2019.

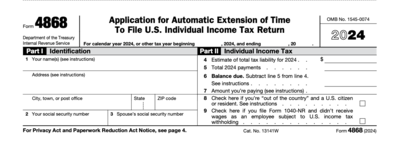

And did you ever file an election with the IRS to treat the entity as a corporation for tax purposes. You must file US. An LLC tax return extension due date may give you six additional months to file or make your business tax payment if you submit Form 7004.

Delaware treats a single-member disregarded entity as a sole proprietorship for tax purposesThis means that the LLC itself does not pay taxes and does not have to file a return with the State of Delaware. An LLC that does not want to accept its default federal tax classification or that wishes to change its classification uses Form 8832 Entity Classification Election PDF to elect how it will be classified for federal tax purposes. Sole Proprietorship Tax Dates.

The answer to the question When are LLC taxes due comes down to whether LLC members owe estimated taxes and how the IRS treats your LLC.

Irs And Many States Announce Tax Filing Extension For 2020 Returns

What Is Form 1120s And How Do I File It Ask Gusto

How To File An Extension For Taxes Form 4868 H R Block

When Is A Corporate Tax Return Due

Texas Franchise Tax Report Report Year And Accounting Period Explained C Brian Streig Cpa

Us Tax Deadlines Updated For Expats Businesses Online Taxman

E File An Irs Tax Extension E File Com

Irs Extends Tax Deadlines For Texas Residents And Businesses Mc Gazette

Understanding The 1065 Form Scalefactor

Form 1065 Instructions Information For Partnership Tax Returns

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Irs Notice Cp518 Tax Return Filing Reminder H R Block

California S 15 Day Rule For Corporations And Llcs Lawinc

When Are Taxes Due For An Llc Legalzoom Com

When Are 2019 Tax Returns Due Every Date You Need To File Business Taxes In 2020

When Are 2019 Tax Returns Due Every Date You Need To File Business Taxes In 2020

Irs Makes It Official Tax Deadline Delayed To May 17 2021 Cpa Practice Advisor

Irs Extends Tax Return Due Date From April 15 To May 17

Will Ohio S Tax Filing Deadline Be Postponed To May 17 To Match The New Irs Deadline Cleveland Com

Post a Comment for "What Is The Due Date For An Llc Tax Return"