Business Tax Id Pa

REV-588 -- Starting a Business in Pennsylvania - A Guide to Pennsylvania Taxes. If an employer is determined to be liable under the PA UC Law an employer UC account number is assigned.

Https Pidcphilablog Com Wp Content Uploads 2020 07 Pa Statewide Small Business Assistance Portalguide V070620 Pdf

Motor and Alternative Fuel Tax Forms.

Business tax id pa. REV-1176 -- e-TIDES Administrative Access Change Request Form. Pennsylvanians Have Free Online Filing Option for PA Income Tax Returns Payments. A Tax ID Number TIN or Employer Identification Number EIN is a unique identifier that the IRS issues to business entities.

If you are opening a business or other entity that will have employees will operate as a Corporation or Partnership is. How to Register for a UC Tax Account. After completing the application you will receive your Tax ID EIN Number via e-mail.

Pay by Electronic Funds Transfer. REV-854 -- EINTax YearAddress Change Coupon and Instructions. Malt Beverage and Liquor Tax Forms.

The PA Online Business Entity Registration PA-100 will assist you in completing all applicable sections that pertain to your business entitys individual registration needs. Harrisburg PA With the deadline to file 2020 Pennsylvania personal income tax returns and make final 2020 income tax payments approaching on Ma. Corporations LLCs and business trusts registered with the Pennsylvania Department of State are not required to.

Apply for a Pennsylvania Tax ID EIN Number Online. Other Tobacco Products Tax Forms. What Is a Pennsylvania Tax ID.

The Revenue ID number is referenced on all correspondence issued by the department. Small Games of Chance Reporting. Pay by CreditDebit Card.

To begin your application select the type of organization or entity you are attempting to obtain a Tax ID EIN Number in Pennsylvania for. Record searches will provide a complete filing history of an entity. It identifies businesses of all types to the IRS.

The TINEIN is to businesses as the Social Security number is to an individual. Department of State Bureau of Corporations and Charitable Organizations PO Box 8722 Harrisburg PA 17105-8722. You may request a written search by submitting a letter to the bureau at.

215 686-6600 Taxes revenuephilagov. Pennsylvania does not use a single tax ID for businesses. Registering for PA Tax Accounts NOTE.

REV-976 -- Election Not To Be Taxed as a Pennsylvania S Corporation. Nearly every kind of business needs an EIN including corporations limited liability companies and partnerships. Your letter must contain the name and address of the entity to be searched.

Department of General Services. Register My Business PA-100 FilePay by Phone TeleFile File By Software. 215 686-6880 Water Water Revenue wrbhelpdeskphilagov.

The UC number facilitates the recording of contributions paid by and benefit payment charges assessed to each individual employer. It also acts as a mechanism to identify the employer in correspondence. The Online PA-100 may be used to register a new business entity add additional taxes or services or to register a new business entity that is acquiring all or part of an existing business entity.

In Pennsylvania your business does not have a single tax id but rather an account number also known as box number for each tax account with the Pennsylvania Department of State. 215 686-6442 Real Estate revenuephilagov. Medical Marijuana Tax Forms.

Penalty and Interest Calculator. This limitation is applicable to all requests for EINs whether online or by fax or mail. EINs are used by businesses to send invoices statements and tax documents.

An employer identification number EIN is a unique nine-digit number assigned to businesses by the Internal Revenue Service for tax-reporting purposes. You may apply for an EIN online if your principal business is located in the United States or US. The person applying online must have a valid Taxpayer Identification Number.

A PA tax ID number lets you operate a business in the state pay taxes and hire employees for your business. Daily Limitation of an Employer Identification Number Effective May 21 2012 to ensure fair and equitable treatment for all taxpayers the Internal Revenue Service will limit Employer Identification Number EIN issuance to one per responsible party per day. SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of federal state and local permits licenses and registrations youll need to run a business.

Pennsylvania Law Government Resources. For example if your business sells candy bars and has employees you will have separate tax accounts with the Pennsylvania Department of Revenue for sales tax and employer withholding tax. Revenue ID to all businesses that have any tax filing obligation with Pennsylvania.

Keystone Opportunity Zone KOZ Forms. REV-748 -- Brochure - Electronic Services for PA Businesses. Department of General Services - Businesses.

Businesses Required To Have Sales Tax Licenses In Pennsylvania Legalzoom Com

Https Www Dgs Pa Gov Small 20diverse 20business 20program Documents Small 20business 20application 20guide Pdf

Https Www Dgs Pa Gov Small 20diverse 20business 20program Documents Small 20business 20application 20guide Pdf

What S An Ein Number How To Get An Ein For Your Llc 3 Ways Llc University

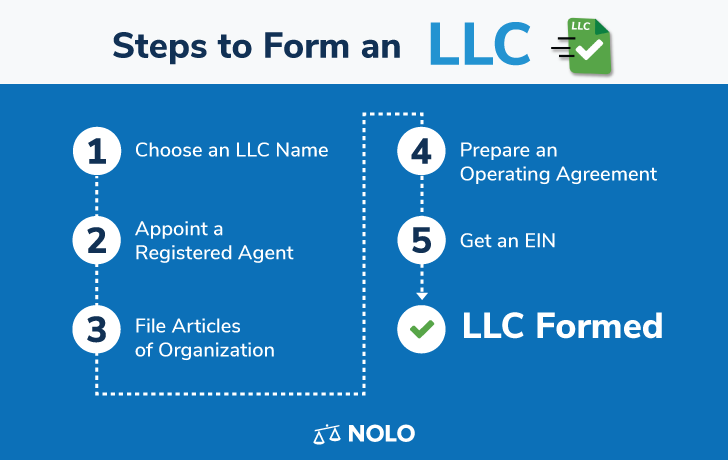

Llc In Pennsylvania How To Form An Llc In Pennsylvania Nolo

How To Get An Exemption Certificate In Pennsylvania Startingyourbusiness Com

Taxes From A To Z 2018 W Is For W 9 Business Checks Tax How To Apply

Does My Business Need A Seller S Permit In Pennsylvania Legalzoom Com

Real Id In Pennsylvania Pa Gov

Https Www Penndot Gov About Us Documents Real 20id 20in 20pennsylvania 20 20overview Pdf

How To Search Available Business Names In Pennsylvania Startingyourbusiness Com

Pa Business One Stop Shop Registering Your Business

Pa Business One Stop Shop Registering Your Business

How To Search Available Business Names In Pennsylvania Startingyourbusiness Com

Pa Business One Stop Shop Registering Your Business

.png)

Post a Comment for "Business Tax Id Pa"