Ohio Business Gateway Cat Quarterly

CAT Returns Semi-Annual Annual Minimum Fee Annual and Quarterly Payment only return already filed CAT Assessment Payments. Ohio Commercial Activity Tax Instructions.

Ohio Llc Steps To Form An Llc In Ohio

U-GR NG Qrtly - Quarterly.

Ohio business gateway cat quarterly. Starting June 30th 2019 you can save edit or delete your ACH or Credit Card information once with your account and it is readily available every time. Below you will find tips and tutorials that will help you log in and get started using the Gateway. Payment - October 15th.

The Ohio Business Gateway is excited to announce our latest feature. Based on your feedback last summer this was the most requested feature to be implemented in future upgrades to the Gateway. If your combined annual gross receipts exceed 400000000.

Gateway services offer Ohios businesses a time- and money-saving online filing and payment system that helps simplify business relationship with government agencies. Register for a vendors license. You will need to file an amended return.

Rule 5703-29-09 allows quarterly taxpayers to estimate their taxable gross receipts for a calendar quarter. Your quarterly return must be filed and paid online through the Ohio Business Gateway. For purposes of the commercial activity tax CAT taxpayers are required to calculate their taxable gross receipts and pay the tax due by the date proscribed in RC5751051.

This rule is now final and effective. Register for file and pay Commercial Activity Tax. The CAT is a prepaid tax.

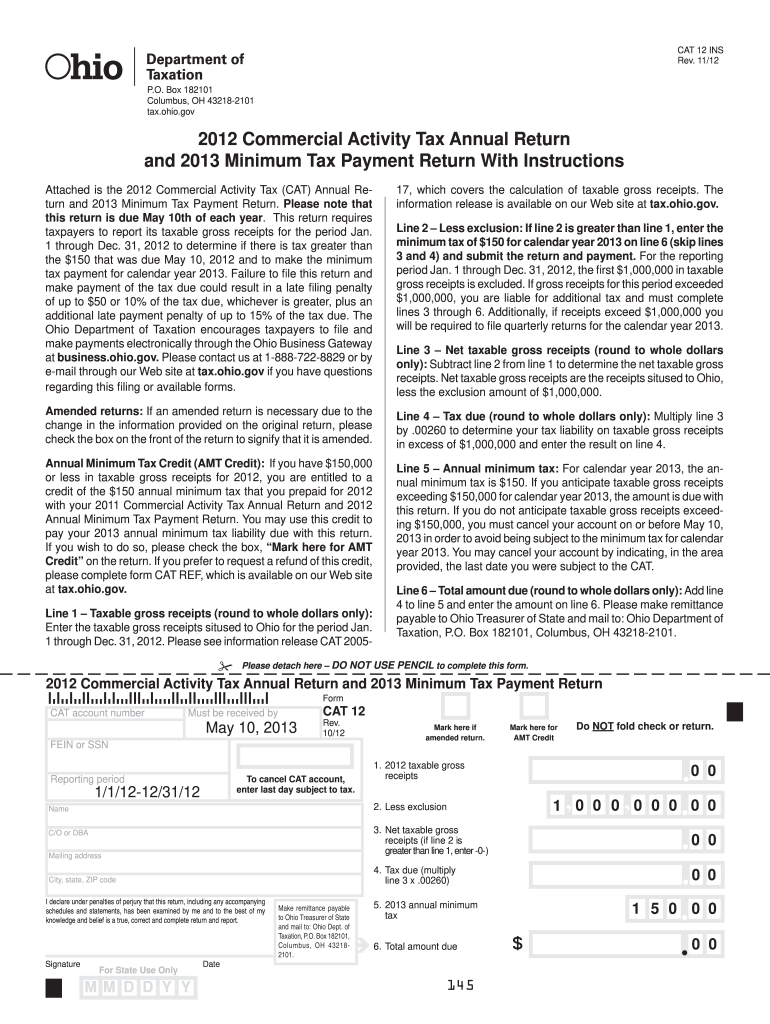

Fill out securely sign print or email your 2013 commercial activity tax annual return form instantly with SignNow. File and pay sales tax and use tax. Addresscontact filing frequency corporate structure and cancel account updates.

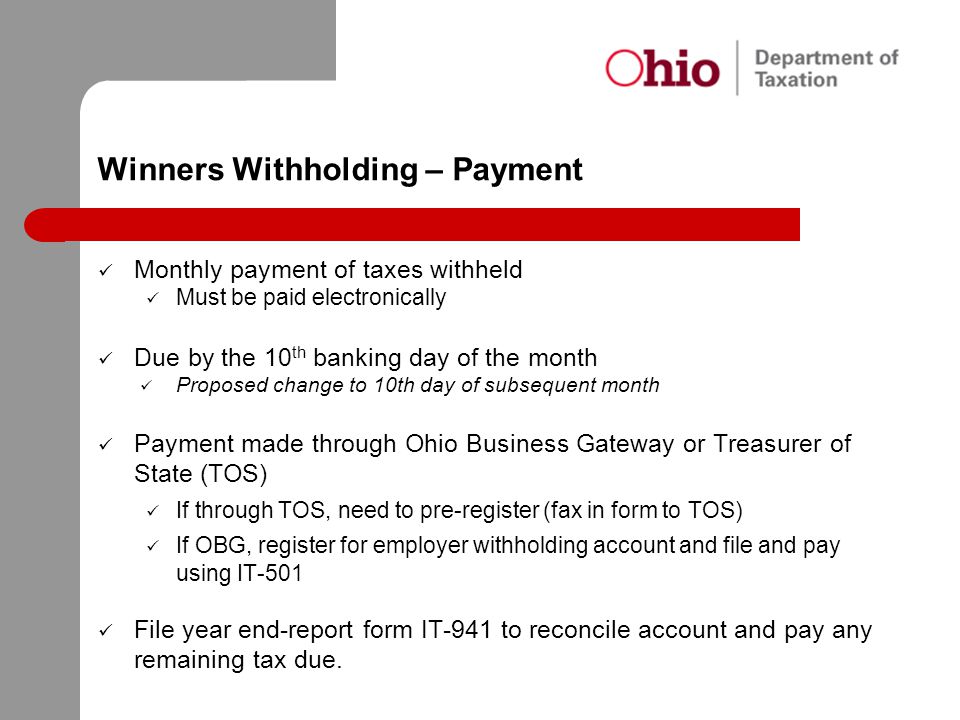

February 14th return period January 1 - December 31 U-GR PL - Annual U-GR Htg-WT-WW - Annual. Quarterly taxpayers are required to pay a 150 annual minimum tax for receipts up to 1000000 with their 1 st quarter payment. Ohio businesses can use the Ohio Business Gateway to access various services and submit transactions and payments with many state agencies such as.

Quarterly returns are required to be filed electronically through the Ohio Business Gateway. I acknowledge that as the creator of a businesss or individuals account for Ohio Business Gateway electronic filing services I am creating a user account for myself that initially has the ability to submit transactions on behalf of the business or. Quarterly Filers - Mandatory electronic filing via Ohio Business Gateway Filing Period.

March 31 2020. Available for PC iOS and Android. Annual taxpayers will be required to file electronically as well beginning January 1 2014.

By selecting Continue you will create a brand new account in the Ohio Business Gateway which only should be done if you have never accessed the Gateway in the past. Welcome to the Ohio Business Gateway. U-GR NG Annual - Annual.

Start a free trial now to save yourself time and money. 1st quarter - May 15th 2nd quarter - August 14th 3rd quarter - November 14th 4th quarter - February 14th. Therefore the annual minimum tax is due in advance on May 10 of the current tax year.

Please direct any questions to the Commercial Activity Tax Division of the Ohio Department of Taxation at 1-888-722-8829. Get Started Using the Gateway. March 31 2020.

Your tax will be 210000 on the first 100000000 plus 026 percent of the excess. It provides tools that make it easier for any business owner to file and pay sales tax commercial activity tax employer withholding unemployment compensation contributions workers compensation premiums and municipal income. File Unemployment Compensation Tax.

Additional information and materials about how to use the Gateway can be found in the Gateways Help Center once you log in. You will be required to file quarterly. Quarterly taxpayers will be required to file an amended return via the Ohio Business Gateway businessohiogov.

The commercial activity tax CAT is an annual tax imposed on the privilege of doing business in Ohio measured by gross receipts from business activities in Ohio. Commercial Activity Tax Sales and Use Tax Severance Tax and Horseracing Tax Casino IFTA Kilo Watt Hour Kilo Watt SAP Motor Fuel Natural Gas PAT FIT E911 Tire Fee Replacement Cigarette Tax Other Tobacco Products Tax and Master Settlement Agreement compliance areas will be unavailable for 1 hour. Alternatively taxpayers may follow a statutory-based estimation procedure to estimate their taxable gross receipts for a quarter.

The most secure digital platform to get legally binding electronically signed documents in just a few seconds. Due August 1st return period May 1st - April 30th Estimated Payments. This rule specifies that quarterly taxpayers must both file and pay electronically.

If you have used the previous Gateway shown below but this is your first time visiting the modernized Gateway click the Cancel button and enter the username and password you have always used to access the Gateway. Alternatively annual filers may file an amended return via TeleFile. Ohios one-stop online shop for business tax filing is designed to streamline the relationship between commerce and government.

Businesses with Ohio taxable gross receipts of 150000 or more per calendar year must register for the CAT file all the applicable returns and make all corresponding payments. Annual filers may file an amended return via the Ohio Business Gateway businessohiogov. The Ohio Business Gateway is a nationally-recognized collaborative initiative of state and local government agencies and an important part of Ohios digital government strategy.

In addition quarterly taxpayers pay a rate component for taxable gross receipts in excess of 1000000.

Commercial Activity Tax Cat Department Of Taxation

Https Tax Ohio Gov Portals 0 Research Vta May2018 Session4 Pdf Pdf

Commercial Activity Tax Cat General Information Department Of Taxation

Ohio Department Of Taxation Posts Facebook

Https Tax Ohio Gov Static Online Services Ohiobusinessgatewaypresentation Pdf

Https Tax Ohio Gov Portals 0 Research Vta May2019 Session2 Pdf

Https Tax Ohio Gov Portals 0 Forms Cat Generic Cat 201 20landing 20page Pdf

Online Services Introduction Department Of Taxation

Commercial Activity Tax Cat General Information Department Of Taxation

Ohio Cat Tax Worksheet Fill Online Printable Fillable Blank Pdffiller

Ohio Department Of Taxation S Casino Training Ppt Download

Are You Confused By The Commercial Activity Tax Cat

Ohio Department Of Taxation S Casino Training Ppt Download

Ohio Department Of Taxation S Casino Training Ppt Download

How To File Sales Tax Department Of Taxation

Https Tax Ohio Gov Portals 0 Communications Publications Brief Summaries 2009 Brief Summary Commercial Activity Tax Pdf

Https Www Tax Ohio Gov Portals 0 Ohiotaxalert Archivedalerts Catfilingreminder41020 Pdf

Https Tax Ohio Gov Portals 0 Research Vta May2018 Session4 Pdf Pdf

Post a Comment for "Ohio Business Gateway Cat Quarterly"