Business Use Of Home And Principal Residence Exemption

Live in a different home to your spouse or children you need to choose which home will be your main residence use your home to produce income such as renting it out running a home business or flipping your home you dont get the full main residence exemption and may need to know your homes market value at the time you first used it to produce income. Your family is generally considered to be your spouse and children.

Here S A Summary Of The Main Changes With The New Tax Law Passed Last Month Capital Gain Tax Deductions Home Ownership

One of the largest tax breaks Canadians have is the ability to claim the principal residence exemption PRE on the sale of their homes.

Business use of home and principal residence exemption. Sale of Your Main Home In this section well record the sale of your main home your principal residence where you spend most of your time. The exemption applies even when the income support recipient expects to be absent for more than 12 months. The PRE provides a homeowner with an exemption from tax on the capital gain realized when they sell the property that they have designated as their principal residence.

121 a taxpayer can exclude up to 250000 500000 if married filing jointly from gross income on the sale or exchange of his or her principal residence provided the taxpayer owned and occupied the property as his or her principal residence for an aggregate two-year period during the five-year period ending on the date of the sale or exchange. The combination of your home office and rental portion cannot exceed 50 to preserve the principal residence exemption. If you have a bungalow rent out the basement and use one room in the main floor as your home office the income producing use including basement and the one room are now the main use.

If you claim CCA the property will be deemed to be income generating rather than a principal residence and thus will not be eligible for the principal residence exemption. The tax code recognizes the importance of home ownership by allowing you to exclude gain when you sell your main home. Number of years home was principal residence 1 x capital gain number of years owned The formula is mainly used if the property was not your principal residence for the entire duration of time that you owned it.

The Principal Residence Exemption Formula according to Taxtipsca is. If an income support recipient temporarily vacates the principal home the home continues to be the principal home and the income support recipient continues to be defined as a homeowner for up to 12 months. Therefore you risk losing some or all of the 4 additional years you get for the principal residence exemption while you.

Either 24 full months or 730 days will satisfy the two-year ownership and use requirements. Youre effectively claiming a tax deduction equal to the cost of the portion your home dedicated to your office. This does not include the sale of a vacation home or a second home.

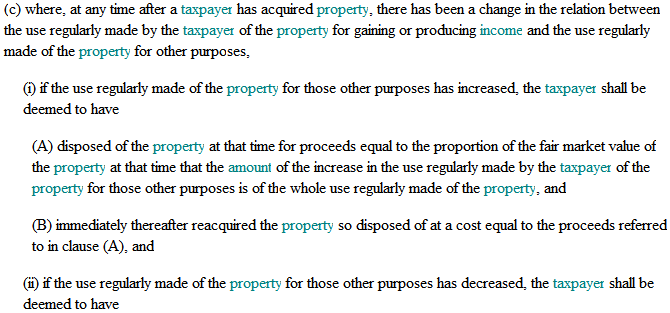

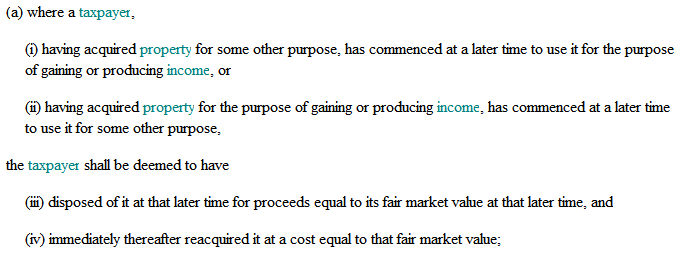

121 exclusion does not apply. CHANGE IN USE OF PRINCIPAL RESIDENCE To qualify for the Principal Residence Exemption you or your family must live in your Principal Residence at some time during a year in the PR you are claiming the PRE for. Also the exclusion is inapplicable to a portion of the property that is separate from the dwelling unit.

Line 34 is the total other than casualty losses allowable as a deduction for business use of your home. For example you could depreciate 15 of your homes value if your office takes up 15 of your homes square footage. To qualify for the maximum exclusion of gain 250000 or 500000 if married filing jointly you must meet the Eligibility Test explained later.

You have not used a part of your home exclusively for business purposes using a room as a temporary or occasional office does not count as exclusive business use the grounds including all. Business Use of the Residence If part of the principal residence is used for business purposes the IRC. At least thats the rule to the extent any depreciation is claimed.

However an individual who is a member of the partnership could use the principal residence exemption to reduce or eliminate the portion of any gain on the disposition of the property which is allocated to that partner pursuant to the partnership agreement provided that the other requirements of the section 54 definition of principal residence are met for example if the partner resides in the partnerships housing. Principal Residence Exemption Tax Issues When Selling. 225 Interest arising on borrowed money used to purchase a principal residence will not generally qualify for deduction Under paragraph 20 1 c because the borrowed money will not be used for the purpose of earning income from a business or property.

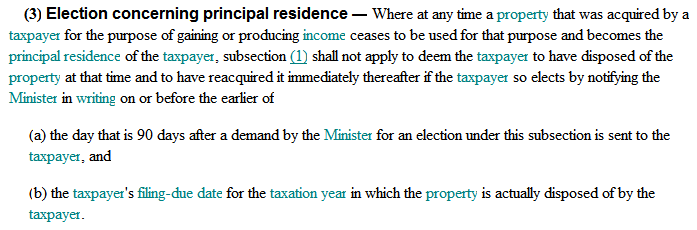

This unit is a rental property while sold and I do own and live in another home for 2 years. Tax law also provides that you can depreciate the portion of your property used for business purposes. 452 Election to Defer Capital Gain on Change in Use from Principal Residence to Income-Producing Property If a taxpayer begins using their principal residence for an income-earning purpose subsection 452 allows the taxpayer to elect out being deemed to have disposed of the property at fair market value and reacquire it immediately thereafter at the same amount.

If you file Schedule F Form 1040 enter this amount on line 32 Other expenses of Schedule F Form 1040 and enter Business Use of Home on the line beside the entry. The gain on the sale of a home is excluded from income only if during that five-year period the taxpayer owns and uses the property as a principal residence for periods totaling two years or more.

Real Estate Homeowner Hacks Homesteading Real Estate

Do I Have To Pay Taxes On The Sale Of My House It Depends Wffa Cpas

How To Avoid Capital Gains Taxes When Selling Your House 2020

Renting Out A Principal Residence Change In Use Rules Htk Academy

Types Of 1031 Exchange Properties Commercial Property Exchange Property

Renting Out A Principal Residence Change In Use Rules Htk Academy

Renting Out A Principal Residence Change In Use Rules Htk Academy

Good Comparison Of The House Vs Senate Tax Bills Tax Deductions Senate Bills

Principal Residence Exemption Guidelines Manning Elliott Llp Accountants Business Advisors

What Are The Advantages Of Homesteading Your Property In Certain States Homeowners Can Take Advantage Of What S Cal Property Tax Homeowner Republic Of Texas

Attention If You Bought A Home Re Financed A Home Or Revised The Way You Hold Title To Your Home This Year Check On Buying A New Home Finance Home Buying

File A Principal Residence Exemption Pre To Save 900 Per Year On A 100k Property It Only Takes 5 Minutes To D Homeowners Insurance Home Buying Real Estate

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

1040 Sale Of Primary Residence Used As Rental

![]()

Can I Put My Primary Residence In An Llc New Silver

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Post a Comment for "Business Use Of Home And Principal Residence Exemption"