Business Types Not Eligible For Ppp

For most borrowers the maximum loan amount of a Second Draw PPP loan is 25x the average monthly 2019 or 2020 payroll costs up to 2 million. For example shopping centers salon suites and similar business models that generate income by renting space to accommodate independent businesses that provide services directly to the public are not eligible.

Startup Funding 5 Types Of Funding 5 Tips To Get Started Startup Funding Business Loans Start Up

Certain business types may have been overridden by PPP rules.

Business types not eligible for ppp. For example shopping centers salon suites and similar business models that generate income by renting space to accommodate independent businesses that provide services directly to the public are not eligible. The top requirements for SBA 7 a loan eligibility is that your business be for-profit and mainly operate within the United States which includes a large swath of business entities eligible for funding. For determining whether it is eligible to apply for and receive a loan.

PPP Ineligible Business Types. A Non-profit businesses for-profit subsidiaries are eligible. SBA loan approval is easier in certain industries than in others but ultimately SBA 7 a loan approval will be determined by the.

The following types of businesses are ineligible. Maximum loan amount and increased assistance for accommodation and food services businesses. Life insurance companies but not independent agents.

C Passive businesses owned by developers and landlords that do not actively use or occupy the assets acquired or improved with the loan proceeds except Eligible. In general the ineligibility restrictions in 13 CFR 120110 apply to all PPP loans but certain sections do not apply or are suspended for PPP loanssuch as nonprofits legal gambling certain religious organizations certain lobbying activities and the rules relating to incarceration probation parole or indictment for a felony. Mortgage companies that make loans and hold them in their portfolio are not eligible.

Some Financial Businesses May Be Ineligible for the SBAs Paycheck Protection Program. Sorry Youre Not Eligible For PPP Money. For instance the second IFR deemed faith-based businesses eligible the third IFR relaxed.

Businesses that lease land for the installation of a cell phone tower solar panels billboards or wind turbine also are not eligible. Businesses must have used or will use the full amount of the initial PPP loan for authorized purposes on or before the expected date of disbursement of the Second Draw PPP Loan Certain types of businesses are not eligible including most businesses normally not eligible for SBA loans businesses where the primary activity is lobbying and businesses with certain ties to China. For borrowers in the Accommodation and Food Services sector use NAICS 72 to confirm the maximum loan amount.

If any of the following statements apply to your business you are not eligible for any PPP loan. Businesses that lease land for the installation of a cell phone tower solar panels billboards or wind turbine also are not eligible. Businesses deriving more than 13 of gross annual revenue from legal gambling activities 7.

Private clubs and businesses which restrict patronage 8. Other businesses whose stock in trade is money. For detailed information on ineligible businesses under SBA 7a program ineligibility of certain business types may have been overridden by PPP rules.

B Financial businesses primarily engaged in the business of lending such as banks finance companies and factors pawn shops although engaged in lending may qualify in some circumstances. A check cashing business is eligible if it receives more than 50 of its revenue from the service of cashing. Certain passive businesses owned by developers and landlords which do not actively use or occupy the assets.

You were not in operation on or before February 15 2020 You only employ household employees such as nannies or housekeepers this is not considered a business An owner of 20 or more of the business has a prior fraud related criminal record. Pyramid sale distribution plans 6. For example ineligible businesses include.

SOP 50 10 can be found here. Constantly Changing Guidelines Leave Many Small Businesses Confused. Businesses that have defaulted on federal loans.

Businesses located in a foreign country except businesses in the US. Businesses that are not eligible for Paycheck Protection Program PPP loans are identified in 13 CFR 120110 and described further in SBAs Standard Operating Procedure SOP 50 10 Subpart B Chapter 2 except that nonprofit organizations authorized under the Act are eligible. For detailed information on.

General SBA Ineligible Businesses as Modified by the PPP Rules. Government-owned entities except for tribal businesses 9. Owned by aliens may be eligible 5.

For PPP purposes the SBAs standard operating procedures makes some businesses ineligible and the Treasury Department has provided further guidance. Life Insurance Companies but not independent agents.

7 Alternative Options If You Can T Get A Ppp Loan In 2021 Funding Circle

A Guide To Applying For Ppp Loan Forgiveness

Paycheck Protection Program How It Works Funding Circle

What Small Business Owners Need To Know About The New Round Of Ppp Loans

Documents Required To Apply For A Ppp Loan Bench Accounting

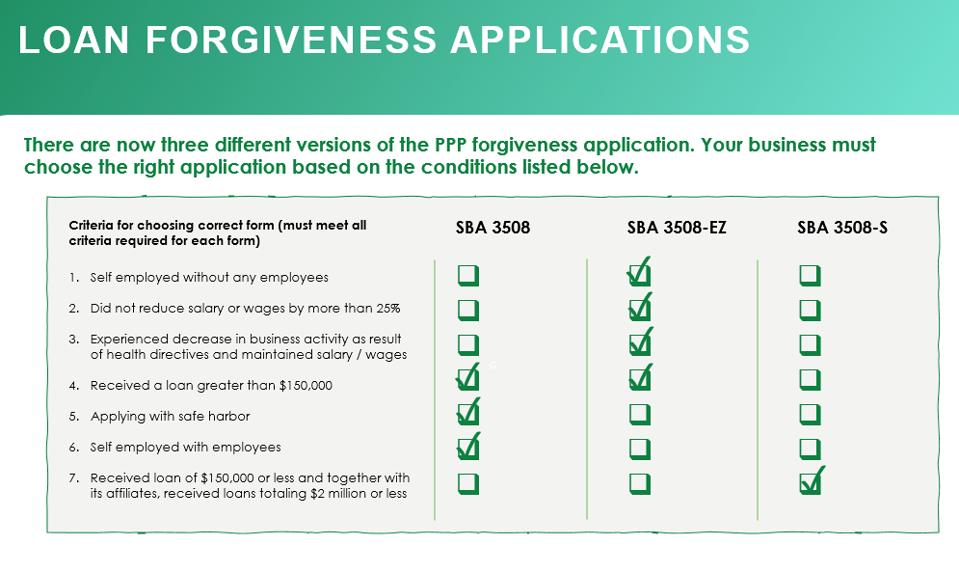

Ppp Forgiveness Forms 3508 Vs 3508ez Vs 3508s

Small Business Entrepreneurship Council

New Paycheck Protection Program Ppp Loans How To Qualify And Apply Nav

Everything You Need To Know About Ppp Loans In 2021 Funding Circle

Fast Personalized Ppp Loans For Small Businesses Revenued

Paycheck Protection Program How It Works Funding Circle

Do Owner Draws Count As Salary For The Paycheck Protection Program Bench Accounting

Pin On Lighted Channel Letters

Post a Comment for "Business Types Not Eligible For Ppp"