What Is The Uk Mileage Rate For 2020

Anything over this can be claimed as an expense at a rate of 25p per mile. This means you can claim tax back at a rate of 6p per mile that is 600.

Https F Hubspotusercontent40 Net Hubfs 5847593 Hro 20mileage 20reimbursement 20per 20country 20in 20europe Pdf

UPDATED FEB 26 2021 1 MIN READ.

What is the uk mileage rate for 2020. Employees can claim 45p per mile for the first 10000 business miles in the financial year and 25p per mile thereafter. The rates apply for any business journeys you make between 6 April 2020 and 5 April 2021. How rates are calculated.

As a result the current AMAP rates are 45p per mile for the first 10000 miles and 25p. 6 April 2017 Rates allowances and duties have been updated for. If this is the case you will be able to claim Mileage Allowance Relief MAR.

Heres an overview of HMRCs current advisory mileage allowance rates. HMRC approved mileage rates for 2021. If you are paid a car allowance your employer may reimburse you at a lower mileage rate or not at all.

The mileage rate is meant to simplify the record-keeping process ease the administrative burden and alleviate costs for both businesses and the tax authority. Lower standard rate for each additional mile over 10000 miles. As of 1 September 2019 the Advisory Fuel Rates were set out as below including for the first time Advisory Electricity Rates AERs to be.

6000 miles x 25p 1500. She can claim the first 10000 miles as a business expense at a rate of 45p per mile. 10000 miles x 45p 4500.

45 pence per mile for cars and goods vehicles on the first 10000 miles travelled 25 pence over 10000 miles 24 pence per mile for motorcycles. If an employer pays more than these amounts then the additional amount paid will be taxed as income. In fact the last time AMAP rates changed was in April 2012 when the AMAP rate for the first 10000 car and van miles rose from 40p per mile to 45p per mile.

Any reimbursement by the employer for business mileage is tax and NIC free provided its no higher than the above AMAP rates. For motorcycles it is 24 pence and for a bike 20pence per mile. HMRC sets and approves mileage rates for each year and that rate has remained the same since 2011.

U n i t e d K i n g d o m Car below 900 cm3 05214 Polish Zloty per km Car above 900 cm3 08358 Motorcycle 02302 P o l a n d. Information has been updated to include tax years 2018 to 2019 and 2019 to 2020 also removed some older details. OCONUS World Per Diem Rates.

The mileage rates for the current 20212022 tax year. Standard rate for the first 10000 miles in the tax year. Mileage Allowance Own Transport Mileage Rate Transport Provided 0 15 miles Nil Nil Over 15 miles 22p 12p 1st Call-Out 2000 Subsequent call-out same rest period 1000 Note.

Based on the latest fuel advisory rates you could claim 10000 miles at 12p per mile that is 1200. All mileage rates are regularly recalculated by the NHS Staff Council taking into account the changing costs of motoring overall and fuel. Mileage Allowance Rate is payable to employees who are being paid Travel Rate and are travelling in their own time.

The mileage reimbursement per kilometre for a car in the UK is 45 pence for the first 10000 miles and above 25 pence. The mileage rates apply only where a company must repay an employee for business travel in a company car or where an employee is required to repay the company for personal travel in a company car. Now lets say your boss reimburses you for fuel at a rate of 6p per mile.

Reimbursements over the above AMAP rates are taxable on the employee and must be reported to HMRC. Theyre identical to the rates that applied during 2019-20. When an employee uses a private car for business purposes and claims mileage at the pre-defined rates currently 45p per mile for the first 10000 miles and 25p per mile thereafter the mileage relief is granted from a wage tax perspective.

Rates in cents per mile. Heres more on how to claim MAR. Claiming tax back on fuel.

The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the deductible costs of operating an automobile for business charitable medical or moving expense purposes. The rates are set under the rules of HMRC simplified expenses a way of HMRC making it easier for people to claim for expenses and keeping it fair for everyone in the UK. Over the course of the 202122 tax year freelance courier Aisha has driven 16000 business miles.

The NHS mileage allowance may not cover all the extra costs of driving for work but it is intended to be a meaningful contribution towards it.

Expense Management Calculated Mileage Rate Tiers Dynamics 365 Finance Forum Community Forum

Claiming For Your Home Office Against Your Taxes Home Office Expenses Business Tax Deductions Small Business Tax

2020 Irs Mileage Reimbursement Update Beginning January 1 2020 The New Standard Mileage Rate Is 57 5 Cents P Nanny Agencies Placement Agencies Nanny Jobs

What Do Most Companies Pay For Mileage Reimbursement

![]()

Free Mileage Tracking Log And Mileage Reimbursement Form

Free Irs Mileage Reimbursement Form Word Pdf

2020 Standard Mileage Rates Announced Mileage Internal Revenue Service Money Matters

How To Record Mileage Help Center

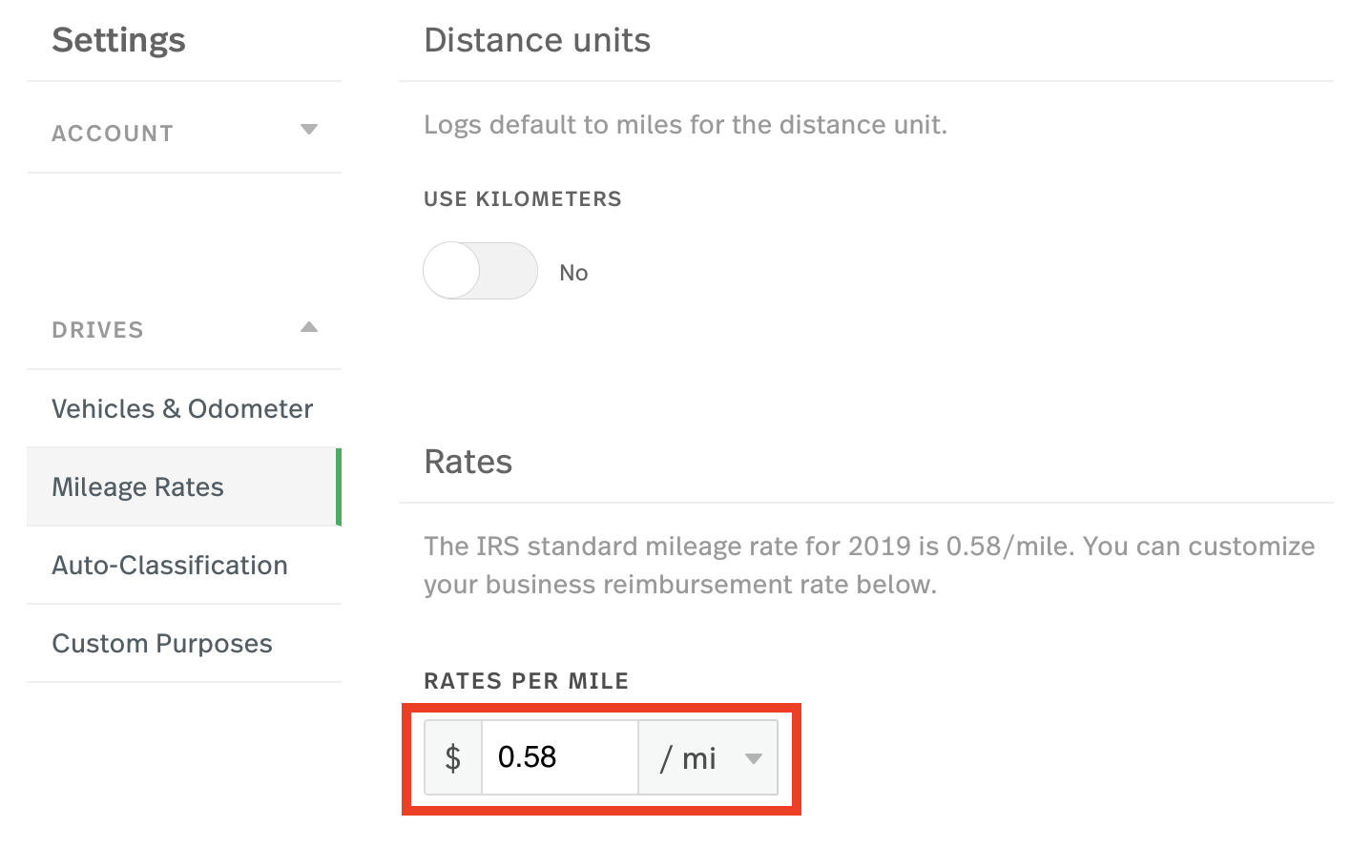

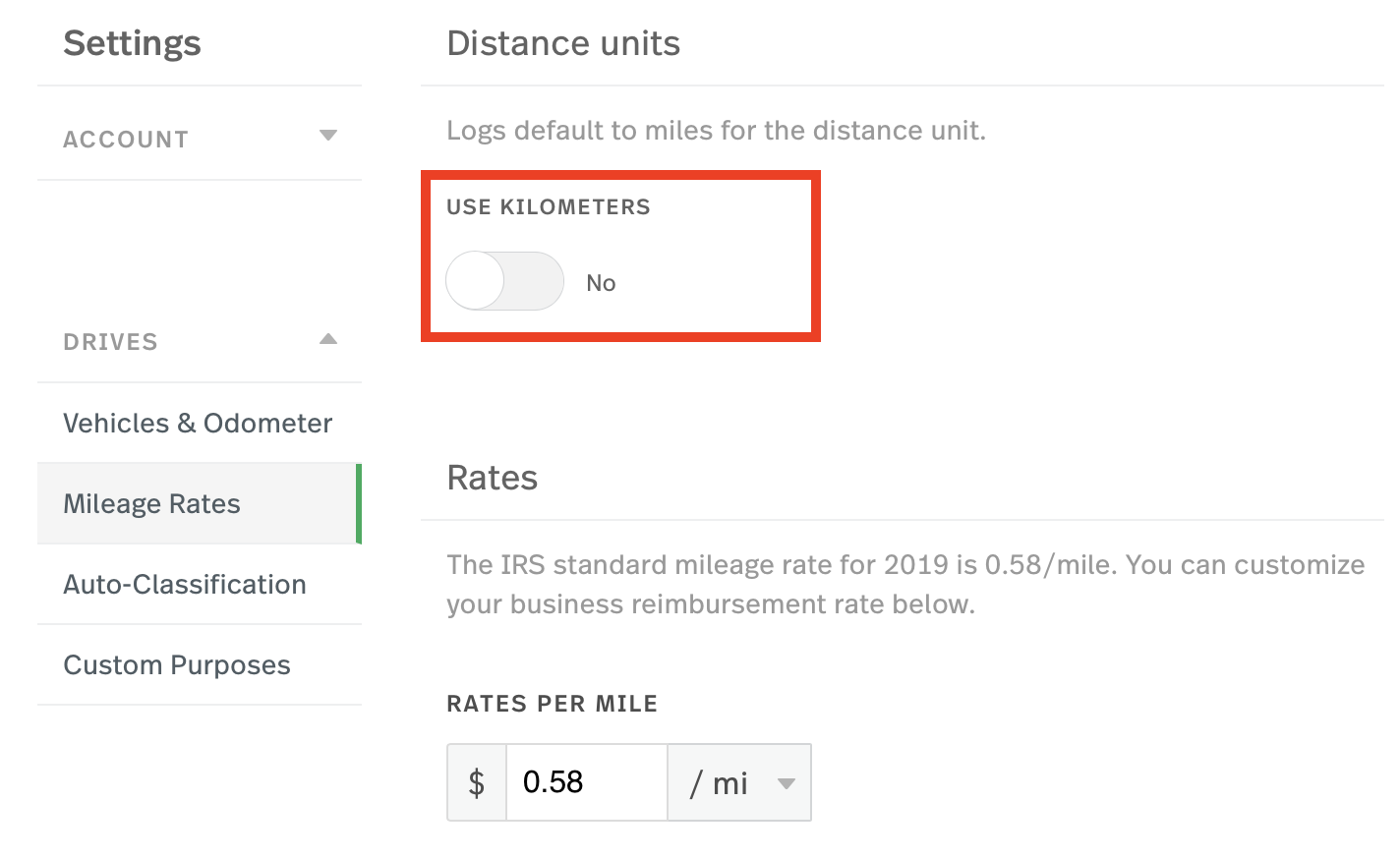

How To Edit The Business Rate And Distance Unit Mileiq

How To Edit The Business Rate And Distance Unit Mileiq

2020 Irs Mileage Rates North Face Logo Retail Logos The North Face Logo

Mileage Reimbursement Calculator For 2018 2019 Https Www Irstaxapp Com Mileage Reimbursement Calculator 2018 2019 Mileage Coding Finance Saving

New Taxation Rules For Non Uk Resident Corporate Landlords Dns Accounting Being A Landlord Income Tax Return Corporate

The Uk Mileage Rate For 2021 Goselfemployed Co

How To Decide An Electric Car Mileage Allowance I T E I

What You Need To Know How To Claim Business Mileage As An Expense Xu Hub

Mileage Log Mileage Tracker For Tax Purposes Printable Etsy In 2021 Work Planner Weekly Work Planner Mileage Tracker

Things To Know To Get Ready For The 2020 Irs Standard Mileage Rate Irs How To Get Things To Know

Your Guide To California Mileage Reimbursement Laws 2020

Post a Comment for "What Is The Uk Mileage Rate For 2020"