Turbotax Small Business Quarterly Taxes

Individuals can use IRS Form 1040-ES to figure their estimated quarterly tax payments. Individuals use the estimated tax worksheet from Form 1040-ES to estimate their quarterly taxes.

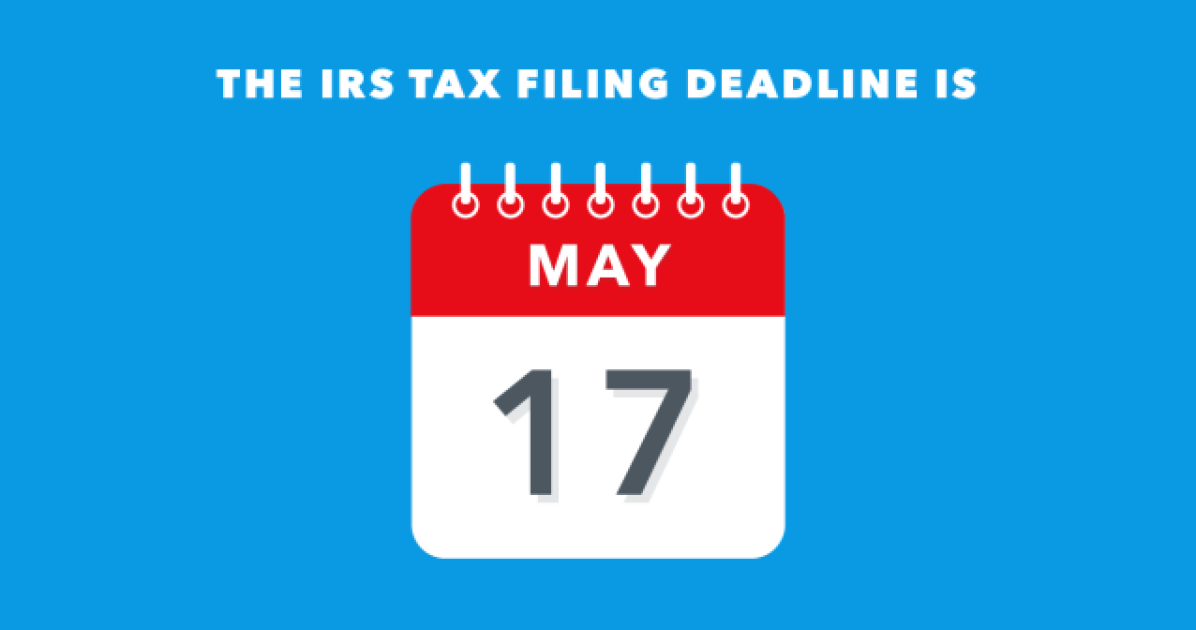

What Is The Best Tax Software 2021 Winners

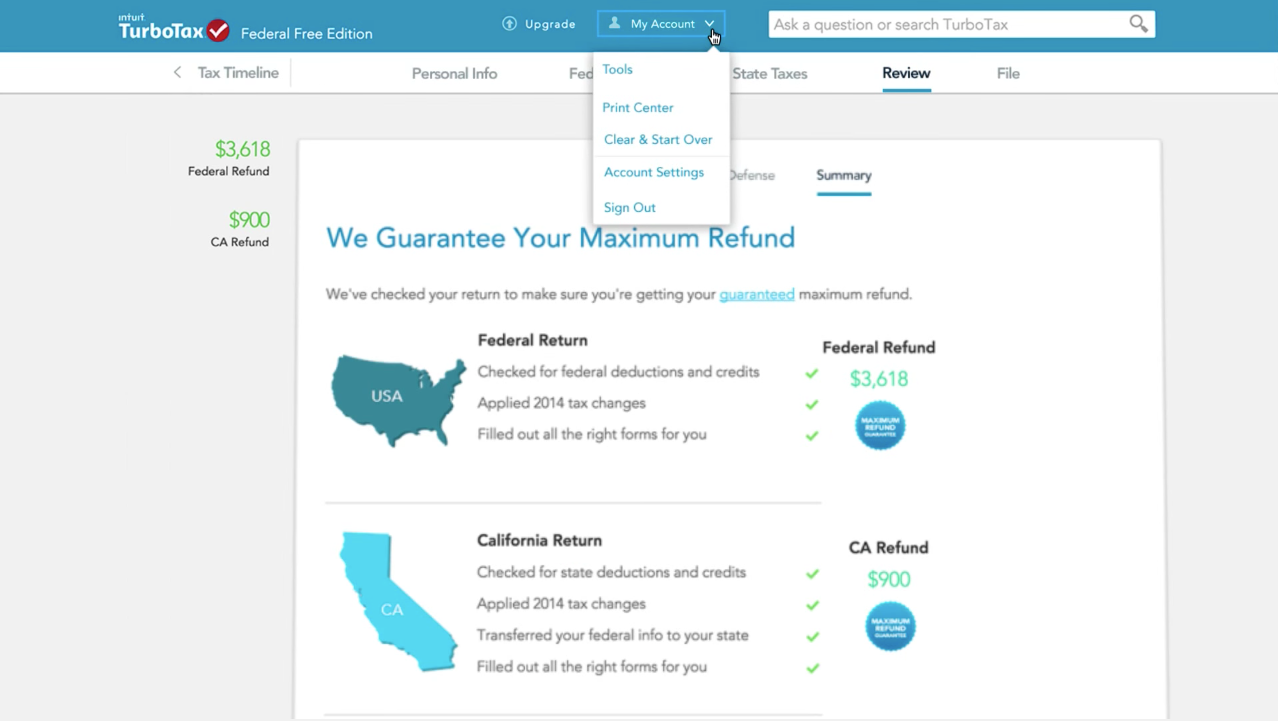

Based on aggregated sales data for all tax year 2019 TurboTax products.

Turbotax small business quarterly taxes. All you have to do is plug and it will take care of the chugging for you. Does turbotax business file form IT-204-LL LLC. TurboTax will make filing less of a hassle.

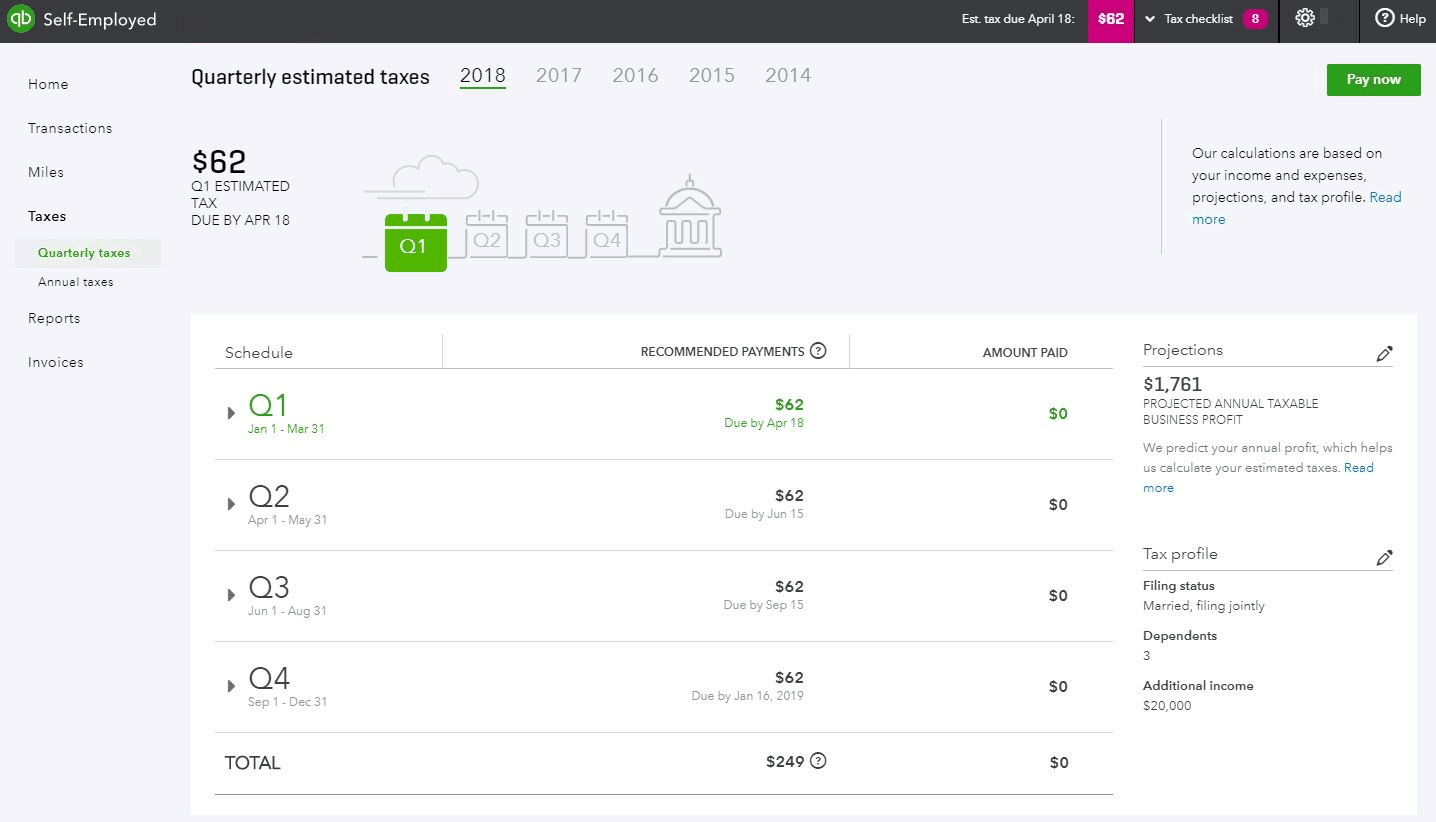

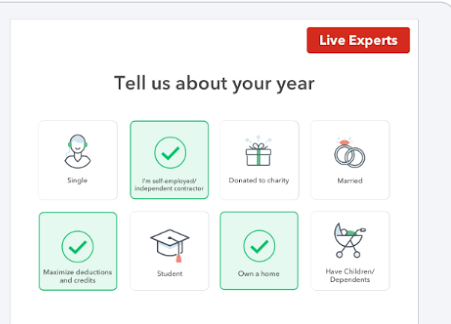

S-Corp Federal Tax Filing Dates A Guide to Paying Quarterly Taxes What is Form 8881. You can also use software like Quickbooks Self Employed to track your income expenses and deductions throughout the year which will help with estimating your quarterly payments. Each additional TurboTax Self-Employed federal tax filing is 11999 and state tax filing is 4499.

Self Employment tax Scheduled SE is automatically generated if a person has 400 or more of net profit from self-employment. Included with all TurboTax Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service or prior year PLUS benefits customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312022. This benefit is available with TurboTax Federal products except TurboTax Business.

Your business may be required to file information returns to report certain types of payments made during the year. Take your estimated tax for the year and divide it by four for the four quarters of the year. In the left pane click Info Wks it should be at or near the top.

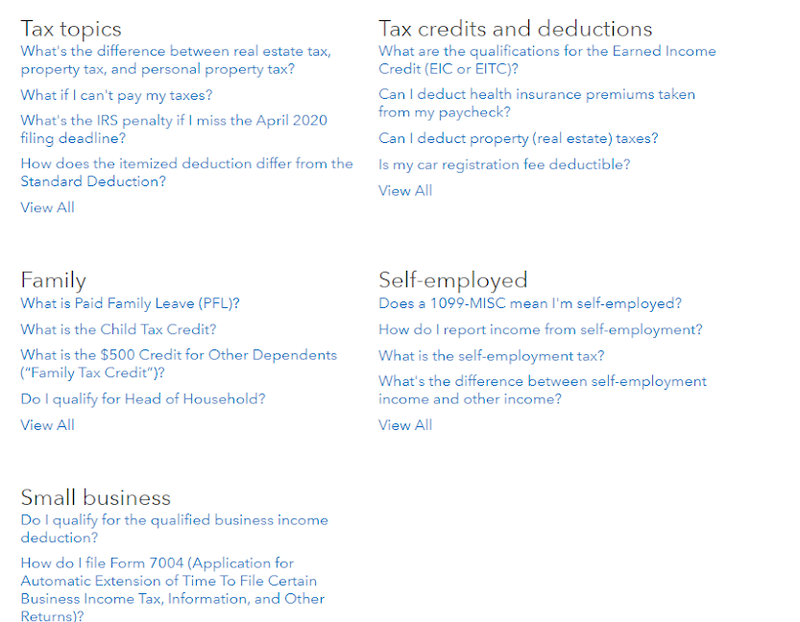

Terms and conditions may vary and are subject to change without notice. Read our articles about Small Business Taxes and find great ways to save on your taxes. When it comes tax time TurboTax will ask you simple questions and fill out all the right forms for you to maximize your tax.

TurboTax provides e-filing taxes services and assistance for those filing as self-employed small business military and retirement tax purposes. The Form IT-204-LLC is not supported for e-filing in 2017 TurboTax Business. Corporations can rely on IRS Form 1120-W Estimated Tax for Corporations to calculate their quarterly taxes.

Each additional TurboTax Live Self-Employed federal tax filing is 19999 and includes live on screen tax advice from a CPA or EA and state tax filing is 4499. If youre in the Step-by-Step interview select Forms in the upper right corner of TurboTax. Click here to download our Self-Employed Tax Prep ChecklistUse this checklist with TurboTax Self-Employed to make filing your income taxes smooth easyHowever if you feel a bit overwhelmed consider TurboTax Live Assist Review Self-Employed and get unlimited help and advice as you do your taxes plus a final review before you file.

If you make less than 150000 per year you have to pay at least 90 of this years taxes or 100 of last years taxes over four quarterly payments to avoid a. Thats your quarterly tax amount. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare.

You can go here State Forms Availability Table for TurboTax Business and it will show you a list of forms supported for NY. Customer service and product support vary by time of year. Before you decide not to file your tax.

Learn your options for e-filing form 940 941 943 944 or 945 for Small Businesses. About our TurboTax Product Experts. 1 best-selling tax software.

The 1040-ES tax form packet has 4 separate. Or choose TurboTax Live Full Service for. Check out helpful tax tips and videos from TurboTax about Small Business Taxes.

Prices are subject to change without notice. In the right pane scroll down to Part III of the Information WorksheetHere is where you enter your quarterly and other payments. 100 of TurboTax Live experts are CPAs EAs or Tax Attorneys.

You pay 153 SE tax on 9235 of your Net Profit greater than 400. The self-employment tax is a social security and Medicare tax for individuals who work for themselves. Estimated tax payments for S corporations will need to be entered in Forms Mode.

Turbotax Home Business Federal State 2019 Windows Digital Int940800v507 Best Buy

Quickbooks Online With Turbotax Creating An Unbeatable Duo Online Accounting Software Reviews

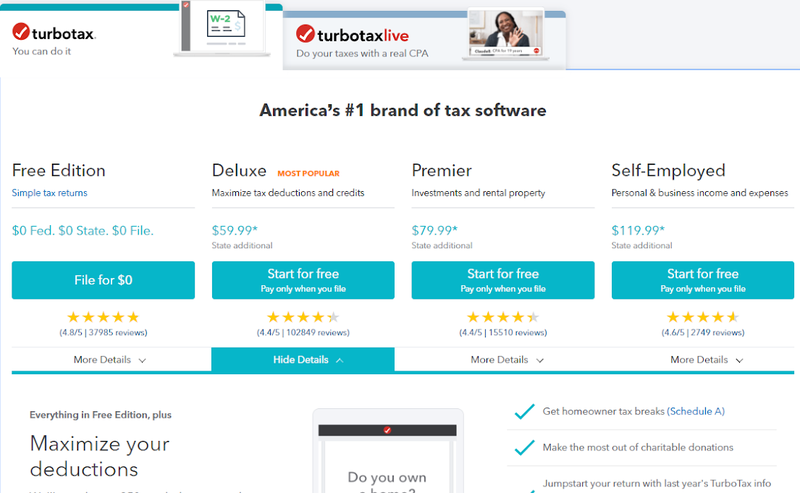

Quickbooks Self Employed Review 2021 Carefulcents Com Quickbooks Tax Software Small Business Accounting

Turbotax And Quickbooks Self Employed What S The Best Deal Jay Versluis

Turbotax Vs An Accountant For Your 2020 Tax Returns

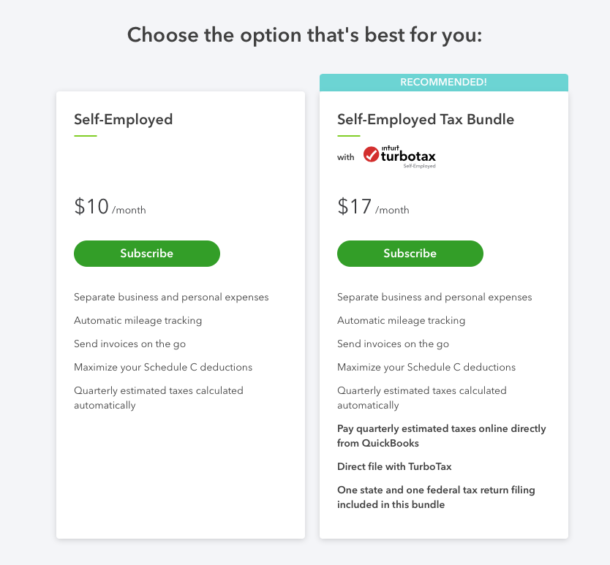

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Turbotax Premier 2021 Service Codes Discounts

Estimated Taxes Common Questions Turbotax Tax Tips Videos

Business Tax Timeline Annual Vs Quarterly Filing Synovus

What Tax Forms To File As A First Time Business Owner The Turbotax Blog

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Turbotax Self Employed Review 2021 Features Pricing The Blueprint

How To Pay Quarterly Taxes If You Re A Business Owner

Turbotax Self Employed Review 2021 Features Pricing The Blueprint

Turbotax Business Pricing Features Reviews Alternatives Getapp

Self Employed Quarterly Tax Date Deadlines For Estimated Taxes The Turbotax Blog

Turbotax Self Employed Review 2021 Features Pricing The Blueprint

Self Employed Quarterly Tax Date Deadlines For Estimated Taxes The Turbotax Blog

Myths About Quarterly Taxes For The 1099 Tax Form Turbotax Tax Tips Videos

Post a Comment for "Turbotax Small Business Quarterly Taxes"