Business Use Of Home Gross Income Limitation

C The tentative amount is a LOSS of 150 or actually any loss. If your home office is 300 square feet or less the IRS has an optional simplified method of calculating your home office deduction.

Understanding Section 179 Tax Deduction For Small Business Infographic Tax Deductions Small Business Infographic Finance Infographic

Your deduction of otherwise nondeductible expenses such as insurance utilities and depreciation with depreciation taken last is limited to the gross income from the business use of your home minus the sum of the following.

Business use of home gross income limitation. You must determine the average of the monthly allowable square footage for the taxable year. Standard deduction of 5 per square foot of home used for business maximum 300 square feet. This is your overall gross income from your trade or business less your deductible costs and expenses of doing business not including the home office deduction.

The following is an example of how to use your income and expenses to determine your home office deduction limit. You can deduct 5 for every square foot of your home office up to a maximum of 1500. B If the tentative amount is a PROFIT of 300 then ONLY 300 can be used as the home office expense.

Business Income Limits in 15 Minutes by Bill Wilson CPCU ARM AIM AAM In this webinar youll learn a technique for ballparking a business income limit without using a BI worksheet. For example if you have a 200-square-foot home office your deduction would be 1000 200 x 5. Limitation on the Deduction The home office deduction is limited to your tentative net income from your trade or business.

Eligible taxpayers can get a deduction of 5 per square foot of the home used for business up to a maximum of 300 square feet. Publication 587 includes a worksheet on this calculation. For example if your home office.

If your gross income from the business use of your home is less than your total business expenses your deduction for certain expenses for the business use of your home is limited. Then NONE of the 500 can be used as the home office expense. If the calculated deductions exceed the yearly limit you can carryover the deductions to the next year.

You dont need to file Form 8829. The information you need is limited and often readily available. Under this safe harbor method depreciation is treated as zero and the taxpayer claims the deduction directly on Schedule C Form 1040 or 1040-SR.

Your total home office expenses are 12000. The deduction limit for the business use of your home is dependent on the gross income of the business primarily used in your home. Your Gross Business Income is 10000.

The gross income limitation is actually the gross sales less the cost of goods sold the business portion of the homes mortgage interest and taxes and the otherwise deductible business expenses that are not related to the homes business use. No home depreciation deduction or later recapture of depreciation for the years the simplified option is used. Allowable home-related itemized deductions claimed in full on Schedule A.

The maximum deduction is 1500. EMPLOYEES WORKING AT HOME If the taxpayer is an employee working at home for the convenience of the employer he or she first must determine the home-office-deduction limitation which is equal to the gross income from the business use of the home office. You are therefore subject to a deduction limit because your expenses are.

10 rows Allowable square footage of home use for business not to exceed 300. The deduction may not exceed business net income gross income derived from the qualified business use of the home minus business deductions. Mortgage interest real estate taxes.

This method may be used as a tool when tentatively quoting business income coverage. Revenue Procedure 2013-13 PDF allows qualifying taxpayers to use a prescribed rate of 5 per square foot of the portion of the home used for business up to a maximum of 300 square feet to compute the business use of home deduction. For this purpose no more than 300 square feet may be taken into account for any one month and you only account for a month in which you had 15 or more days of a qualified business use of your home.

If your gross income from the business use of your home equals or exceeds your total business expenses including depreciation you can deduct all your business expenses related to the use of your home. See IRS Publication 587-Business Use of Your Home for more details. Under the simplified method the standard home office deduction amount is 5 per square foot up to 300 square feet of the area used regularly and exclusively for business.

A If the tentative amount is a PROFIT of 1200 then ALL 500 can be used as the home office expense.

Pay Day Show Me The Money Gross Income And Net Income Teks 5 10b In 2021 Show Me The Money Net Income Google Classroom Activities

What The Government Won T Tell You About Your Tax Refund Small Business Tax Deductions Tax Refund Told You So

Instructions For Form 8990 05 2020 Internal Revenue Service

Gross Vs Net Income Importance Differences And More Bookkeeping Business Finance Investing Accounting And Finance

Section 179 Tax Deduction For 2021 Section179 Org

Deadline For Receiving Stimulus Payment From Irs Approaching News Break Personal Finance Articles Personal Finance Finance

Instructions For Form 8990 05 2020 Internal Revenue Service

Eligibility To Claim Rebate Under Section 87a Fy 2019 20 Ay 2020 21 Illustrations In 2021 Business Tax Deductions Small Business Tax Deductions Tax Deductions

Have You Utilised The Sec 80c Tax Saving Limit Fully Find Out Financial Management Knowledge Quotes Medical Insurance

Home Office Deduction Definition Eligibility Limits Exceldatapro Federal Income Tax Tax Deductions Dearness Allowance

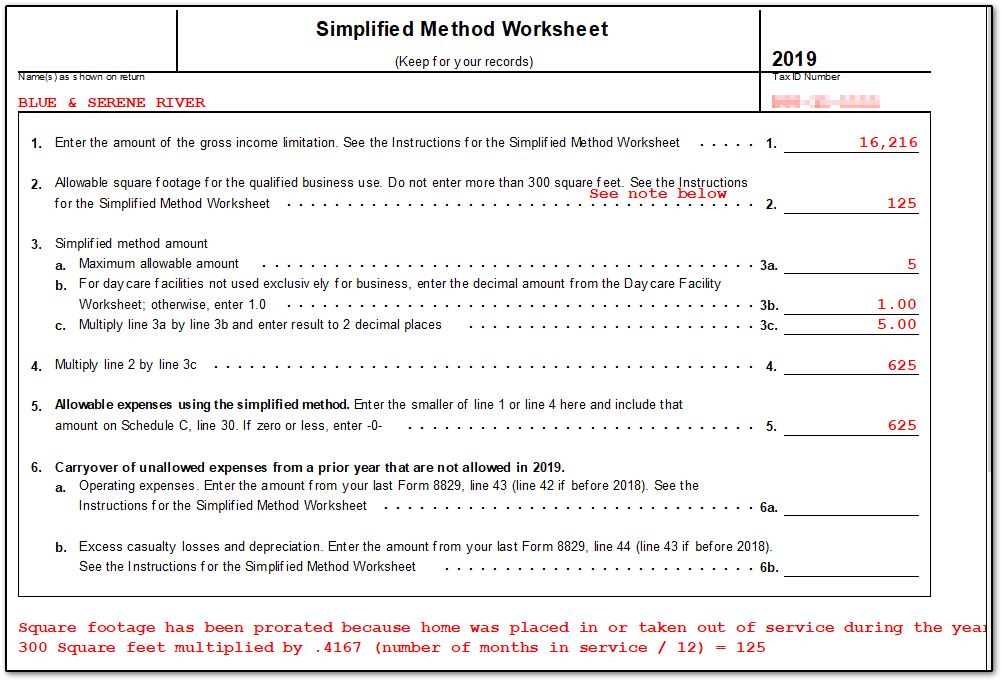

8829 Simplified Method Schedulec Schedulef

Annual Profit Loss Free Office Form Template Document Sample Profit And Loss Statement Statement Template Income Statement

Third Quarter Estimated Tax Payments Due Sept 15 Estimated Tax Payments Tax Payment Irs Taxes

How Tax Planning Helps You Http Www Slideshare Net Financialhospital How Tax Planning Helps You Income Tax Tax Investing

Instructions For Form 8990 05 2020 Internal Revenue Service

2020 Form Irs 2290 Fill Online Printable Fillable Blank In Irs W9 Form 2021 In 2021 Calendar Template Irs Forms Printable Calendar Template

This Is An Image 15050a04 Gif Charitable Contributions Charitable Donations Charitable

Small Business Tax Deductions That Are Easily Overlooked Trax Payroll Small Business Tax Deductions Business Tax Deductions Tax Deductions

Pin By Breanna Simon On Business In 2021 Business Articles Business Simplify

Post a Comment for "Business Use Of Home Gross Income Limitation"