K1 Excess Business Interest Expense

That is not where the deduction is taken. TCJA temporarily repealed miscellaneous itemized expenses subject to 2 adjusted gross income floor and the use for this code has been changed.

Irs Form 1120s Schedule K 1 Download Fillable Pdf Or Fill Online Shareholder S Share Of Income Deductions Credits Etc 2018 Templateroller

It appears that the Form 8990 is unavailable.

K1 excess business interest expense. For example one K-1 may have excess taxable income but wont reporting any excess business interest expense otherwise it would be deducted in the current year. 04-22-2020 0950 AM. In addition if a partnership has negative section 704d expense interest expense that is limited by basis negative section 704d expense becomes excess business interest expense in the year that the basis limitation no longer applies.

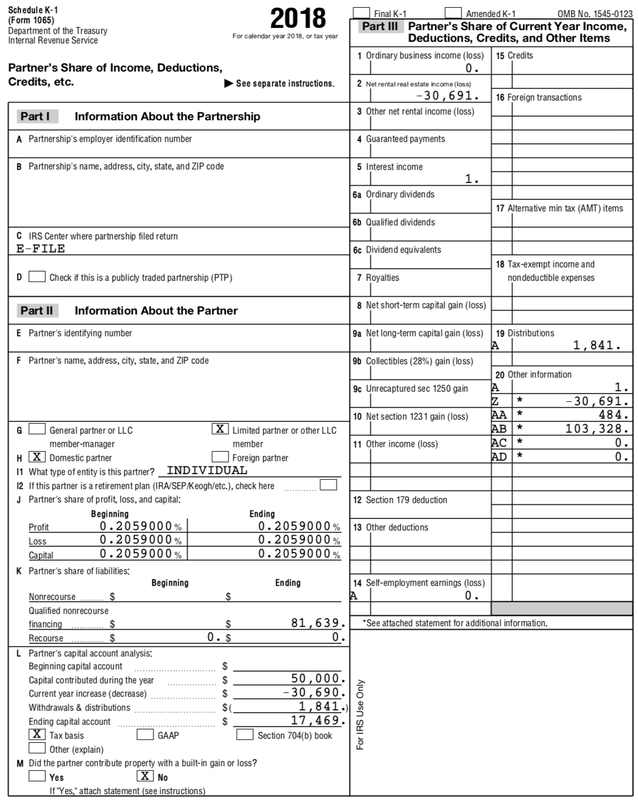

Line 13K - Excess business interest expense - Amounts reported in Box 13 Code K represent a taxpayers share of business interest that was limited under the provisions of the Tax Cuts and Jobs Act. PTP K-1 13K - Excess business interest expense. Ti LLC issues a K-1 to a 50 partner JR LLC in the amount of 525.

That form is used to compute the deductible amount of the excess. Since interest expense is exactly 30 of the partnerships adjusted taxable income it is all deductible. 1040 partner received a K-1 from a 1065 PTP Calumet Specialty Partners showing loss in box 1 and 35K on line 13K Excess business interest expense.

Excess taxable income and excess business interest income or expenses are generally allocated to each partner in the same manner as non-separately stated income. Per Schedule K-1 1065 Partners Instructions page. The expense is a separately stated item on the K-1 and must be entered manually.

Excess business interest expense is only applicable to partnerships subject to section 163j. Since the filing deadline is extended does anyone know if Proseries will have the Form 8990 available soon. Box 20 code AE.

The taxpayers business interest income for the year. I have a customer who received partnership k1 Line 13 Code K for Excess Business Interest Expense. 163 j limit Prop.

An amount on this line in 2018 triggers the filing of new Form 8990 Limitation on Business Interest Expense. If the partner has an amount here they are required to file Form 8990. Disallowed business interest expense is the amount of business interest expense for a tax year in excess of the amount allowed as a deduction for that tax year under the Sec.

Excess business interest expense must be reported on Schedule K-1 so that the taxpayer knows how much to carry forward until they have ETI or excess business interest income to offset it. Instructions for Form 6251. If they have excess interest expense then instead of them carrying this forward it gets passed to the partners via K1 box 13k as excess business interest expense.

It is now for excess business interest expense. Generally taxpayers can deduct interest expense paid or accrued in the taxable year. Prior year carryover excess business interest.

Per the IRS Form 1065 instructions box 13k is the amount from Form 8990 Part II line 32 for excess business interest expense. Ti LLC Partnerships adjusted taxable income is 1500 and business interest expense is 450. The partner will enter the amount on their Form 8990 Schedule A line 43 c.

30 of the taxpayers adjusted taxable income ATI for the year. This is first applied at the partnership level where they have to determine if they have excess business interest expense that they cant deduct from box 1 income. 163J Business Interest Expense Deduction K-1s.

12-07-2019 0840 AM. According to our CPE Vendor Taxspeaker Bob Jennings does not believe that any individual who. GILTI The Global Intangible Low-Taxed Income GILTI provision in the TCJA was created to deter taxpayers from moving income-generating activities to low-taxed jurisdictions.

1163 j- 1 b 8. Excess business interest passes through to the partner and reduces the partners basis in the partnership interest See instructions to 2020s Form 1065 K-1 instructions Codes K AE and AF. Excess business interest expense is applied to basis second.

So in your case with one K-1 youll carryforward the excess business interest expense until a year when THAT entity has excess taxable interest that it can be deducted against. Schedule K-1 Form 1065 - Excess Business Interest Expense If your partnership reported excess business interest expense in Box 13 Code K of your 1065 Schedule K-1 you are required to file Form 8990. However if section 163j applies the amount of deductible business interest expense in a taxable year cannot exceed the sum of.

This information appears on Form 8990 Limitation on Business Interest Expense only if a partnership passed through excess business interest expense using Schedule K-1 code 13K or the Taxpayer is subject to 163 j limitation on business interest field on Screen 8990 is marked.

Schedule K 1 565 Instructions California Franchise Tax Board

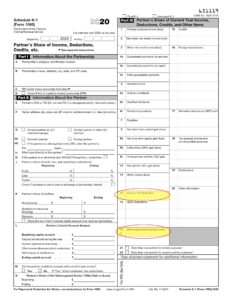

Http Www Cepcpa Com Sites Default Files Form 201065 20schedule 20k 1 20partner 27s 20instructions 202020 Pdf

Instructions For Form 8990 05 2020 Internal Revenue Service

Https Www Rina Com Site Assets Files 1923 2018 Partnership K 1 Instructions Pdf

Instructions For Form 8990 05 2020 Internal Revenue Service

Ppp Guide For Partnerships K 1 1065 Homeunemployed Com

Https Www Irs Gov Pub Irs Utl 2017ntf Dealingpartnershipk1 Pdf

Https Granitereit Com Wp Content Uploads 2019 08 2018 Pro Forma Per Unit K 1 With Footnote 1 Pdf

Https Www Calt Iastate Edu System Files Premium Video Files Partnership 20k 1finalpp Pdf

Dissecting And Understanding A Schedule K 1

Instructions For Form 8990 05 2020 Internal Revenue Service

What Is Schedule K 1 And More Information On Royalties Itin For 8805 And Royalty Income Itincaa

Understanding Your Schedule K 1 And Real Estate Taxes Crowdstreet

Schedule K 1 Entire Lesson Pub 4491 Part 3 Nttc Training Ppt Download

Travel Collocations Worksheet Grammar Worksheets Sentence Construction You Are Incredible

Interest Expense Deduction Part 2 Tax Reform Limits

Partnerships Need To Disclose More Information To Irs

How Schedule K 1 Became Income Investors Worst Enemy The Motley Fool

How Schedule K 1 Became Income Investors Worst Enemy The Motley Fool

Post a Comment for "K1 Excess Business Interest Expense"