Business Risk Non-business Risk And Financial Risk

External risk comes from competition the overall market and changing customer needs. This is what makes a company go bankrupt.

Risk Management Plan In Business Powerpoint Presentation In Small Business Risk Assessment Templ Business Risk Business Powerpoint Presentation Risk Management

Internal risk results from poor management that leads to flawed operational processes and an inability to grow.

Business risk non-business risk and financial risk. Business risk is the exposure a company or organization has to factor s that will lower its profits or lead it to fail. This chapter will discuss non-financial risks. And a restaurant can have financial risk of up to hundreds of thousands of dollars.

Business risk can be reduced through the use of well-grounded decisions while financial risk can be reduced by altering the financing mix to favor a larger proportion of equity over debt. Financial risk is concerned with a company not being able to pay their debts. Business risk of a company refers to the risk because of which the business value of the company can be affected be it via loss of market share or by new entrants who destroy our business or by many other forms of market competition whereas financial risk is the risk of a company where the company could not manage its finances and goes bankrupt because of liquidity risk.

We call these non-financial not so much because they cannot have financial impact but rather to point out that they are different from the investment and underwriting risks addressed in the two previous chapters. Non-financial risks are not less important on the contrary. Unexpected mostly negative actuals different than expected losing some or all original investment 3.

B Unlike financial risk business risk is independent of the amount of debt a business owes. Financial risk relates to how a company uses its financial leverage and manages its debt load. Every business has some degree of financial risk.

Business risk alters income from operations while financial risk alters net income. Introduction to Financial Risk. Business risk and financial risk 2.

Business risk a Business risk refers to the chance a businesss cash flows are not enough to cover its operating expenses like the cost of goods sold rent and wages. Main Differences Between Business Risk and Financial Risk. Business Risk cannot be reduced while Financial Risk can be avoided if the debt capital is not used at all.

Nonfinancial risk comprises compliance risk for instance the requirement to adhere to all relevant rules and. But that risk varies. Risk also includes various factors which may affect desired results of operations or provide unwanted results.

Results proposed that banking system in all over the world is well diversified. Nonfinancial risk 1. Financial Risk is a term applicable to the individual business and government Risk means the probability of losing money in investment or in case of government and business inability to pay off its debt taken from various financial institutions.

Bringing All the Strands Together. Business risk relates to whether a company can make enough in. For the purposes of this article nonfinancial risk is broadly defined as all risk that is not balance-sheet related for example excluding credit foreign-exchange commodity-price and liquidity risk.

Business Risk can be disclosed by the difference in net operating income and net cash flows. Risk is inherent in any business enterprise and good risk management is an essential aspect of running a successful business. Business risk cannot be avoided.

Business risk and financial risk 1. Up to 15 cash back Financial risk in business can be thought of very broadly as two types. In contrast to Financial Risk which can be disclosed by.

The business risk is concerned with the company not able to make enough money to keep its operation going without any hassle. A web business can have financial risk as low as a few hundred dollars if you can build the website on your own. Operational and business risks.

Business Risk Financial Risk Non-Financial Risk Credit Risk Operational Risk Commercial Banks. Internal risk and external risk. Anything that threatens a companys ability to achieve its financial goals.

Types of risk business risk non business risk financial risk 4.

Pin On Grc Governance Risk Management Compliance

Business Risk Assessment Template Elegant 30 Risk Assessment Samples Questionnaire Template Business Risk Business Process

Financial Risk Assessment Template New 9 Risk Assessment Matrix Template Excel Sampletemplatess Business Risk Business Proposal Sample Risk Analysis

Risk Definition Types Adjusment And Measurement

Will The Real Risk Manager Please Stand Up Business Risk Risk Analysis Risk Management

:max_bytes(150000):strip_icc()/balance_sheet-5bfc2f1246e0fb00514577bc.jpg)

Financial Risk Vs Business Risk Understanding The Difference

Operational Risk In 2021 Business Risk Risk Management Financial Management

Orx Reference Taxonomy 2019 Taxonomy Reference Risk

Risk Management Software Risk Management Dashboard Reporting Pertaining To Enterprise Risk Management Report Templat Risk Management Report Template Management

How To Calculate The Impact And Probability Of Business Risk Laconte Consulting Project Risk Management Consulting Business Risk Management

Strategy And Risk 2 Sides Of One Coin Taking Care Of The Present Strategies One Coin Risk

Difference Between Systematic And Unsystematic Risk Market Risk Academic Studies Risk

How To Develop A Risk Assessment Matrix For Business Success How To Advice For Your Side Hustle Or Small Business Business Risk Risk Matrix Success Business

Risk Types Of Risk Business Risk Investing Market Risk

Difference Between Business Risk And Financial Risk With Table Business Risk Financial Market Risk

Pin By Greg Vanlaere On Work Business Risk Market Risk Online Business

Nonprofit Risk Management Risk Management Nonprofit Infographics Non Profit

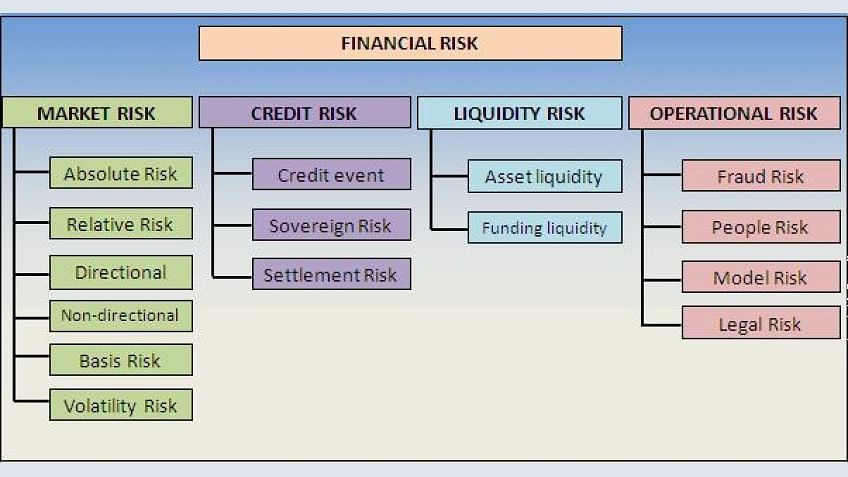

What Is Financial Risks And Its Types

/dotdash_Final_Risk_Feb_2020-01-66f3c5ffb3c040848f1708091fa40eb9.jpg)

Post a Comment for "Business Risk Non-business Risk And Financial Risk"