Do I Need To File K1 With Loss

Download the K-1 tax form and Schedule K-1 instructions. NMI on what you are attempting to.

Form 565 Schedule K 1 Partner S Share Of Income Deductions Credits Etc

Use Schedule K-1 to report a beneficiarys share of the estates or trusts income credits deductions etc on your Form 1040 US.

Do i need to file k1 with loss. Form 1065 Sch K-1 is the form that a business must file as part of its own tax returns to show how it has divided its income or allocated its losses. A partner can also claim any losses or deductions from the business on their tax return though there may be limitations to how much you can claim. You claim a Net Loss Deduction on your December 2018 Form IL-1120.

Individual Income Tax Return. I have a K-1 with no income or loss from a LP limited partnership. S-corporations and other pass-through entities are required to issue their Schedules K-1 by March 15 the deadline for Forms 1120S and 1065.

Information about Schedule K-1 Form 1041 Beneficiarys Share of Income Deductions Credits etc including recent updates related forms and instructions on how to file. With this tax form the business can also track the participation of each partner in the business performance depending on how much capital was invested. Do I need to report it on my tax return.

One more thing before you even get to the point of deducting the loss from the K-1 you must determine that the loss is deductible at allyou must have sufficient tax basis remaining in your investment in the partnership at risk rules - Form 6198 passive loss limitations Form 8582. Single-owner LLCs dont use a Schedule K-1 to report the business income. If for example you and two partners own the company.

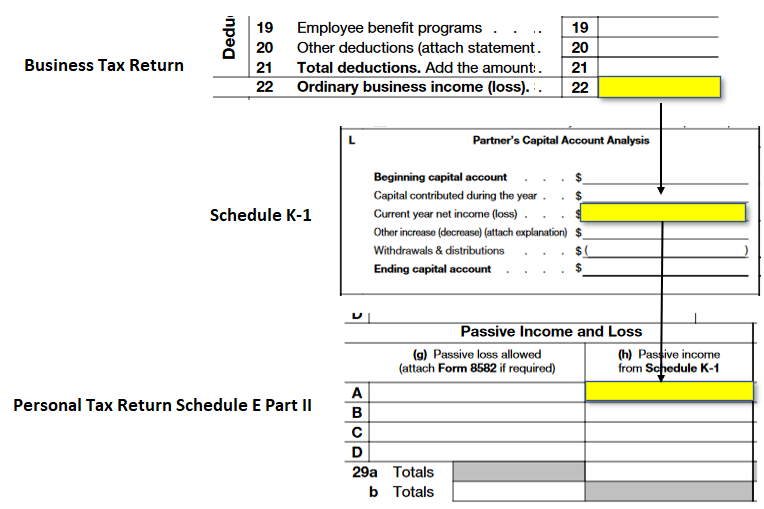

The partner may need to pay tax on their share of the partnership income by reporting it on their individual tax return. 2 Partners and shareholders of S corporations must file a Schedule K-1 to report income losses dividend receipts and capital gains. Youll fill out Schedule K-1 as part of your Partnership Tax Return Form 1065 which reports your partnerships total net income.

The K-1 is prepared by the MMLLC to distribute to the partners to outline their portion of the income loss and deductions. They use a Schedule C-Profit or Loss from Business. On the other hand this form has to be filed if the beneficiary is a nonresident alien regardless of how much or how little income is reported.

That K-1 incomeloss etc gets reported on the individual Form 1040. You cannot use the loss in the future if you do not report it this year. If you are a shareholder in an S-corp or a partner in a partnership understand that the K-1 you receive does not state the taxable amount of your share of the income or loss.

Schedule K-1 is a schedule of IRS Form 1065 that members of a business partnership use to report their share of a partnerships profits losses deductions and credits to the IRS. Because partnerships are so-called pass-through entitiesthey let the profits or losses. Yes you should enter the K-1 on your tax return even if it shows a loss.

I dont think that you doSch C is sole proprietor and K-1 comes from an entity. Since a partnership passes its income or losses through to the individual partners this document is essential for each partner to report their share on their taxes. The instructions mean that you are not allowed to deduct this loss from your other income.

If the loss return calculates an overpayment for which you expect to receive a refund or request a credit carry forward you must file the loss return within 3 years of the extended due date of the loss return to receive a refund or credit carry forward. Schedule K-1 forms are distributed to each partner as part of the Form 1065 filed by the partnership as a whole. IRS Schedule K-1 is the schedule that partnerships S corporations and limited liability companies use to report business income and losses.

It is a passive loss. If the annual gross income from the estate is less than 600 then the estate isnt required to file Schedule K-1 tax forms for beneficiaries. Contents of Schedule K-1 Tax Form Inheritance Statements.

Schedule K-1 is the tax form used by partners and shareholders to report to the Internal Revenue Service their income losses dividends or capital gains during the fiscal year. They are suspended to be used when you have a passive profit or when you sell the units.

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Don T Miss The Deadline For Reporting Your Shareholding Income With Form 1120s Schedule K 1

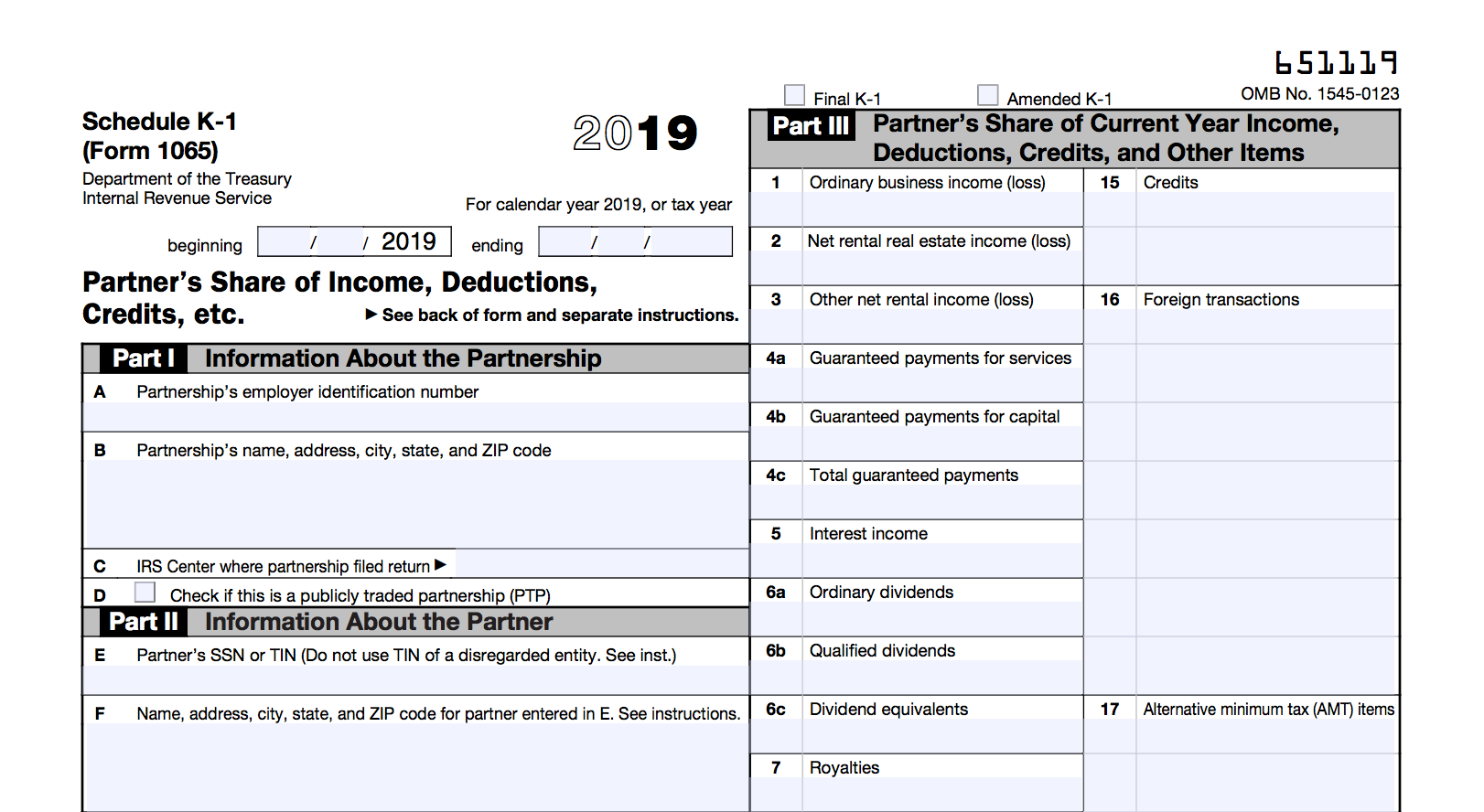

What Is A Schedule K 1 Form Zipbooks

To Win At The Tax Game Know The Rules Published 2015 Irs Tax Forms Tax Forms Irs Taxes

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

3 Ways To Fill Out And File A Schedule K 1 Wikihow

3 Ways To Fill Out And File A Schedule K 1 Wikihow

3 0 101 Schedule K 1 Processing Internal Revenue Service

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

3 Ways To Fill Out And File A Schedule K 1 Wikihow

What Is A Schedule K 1 Tax Form Meru Accounting

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

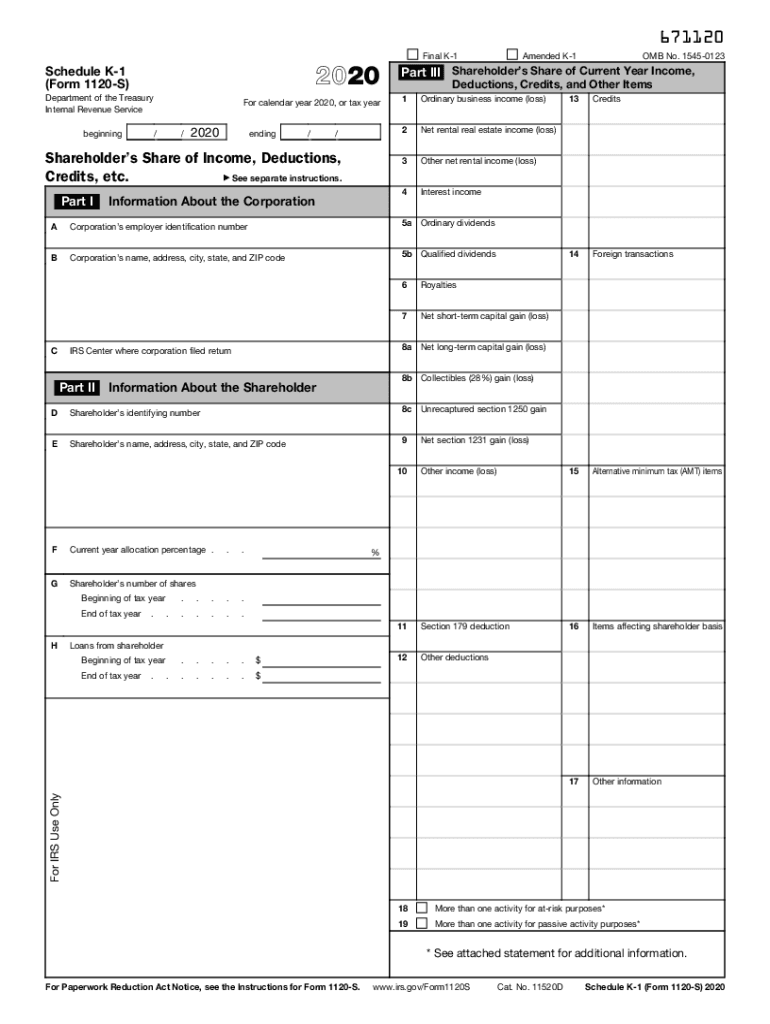

Irs 1120s Schedule K 1 2020 2021 Fill Out Tax Template Online Us Legal Forms

A Small Business Guide To The Schedule K 1 Tax Form The Blueprint

Irs 1065 Schedule K 1 2020 2021 Fill Out Tax Template Online Us Legal Forms

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

How Do I Report Partnership Schedule K 1 Box 13 Co Intuit Accountants Community

Post a Comment for "Do I Need To File K1 With Loss"