Employee Business Expenses Qualified Performing Artist

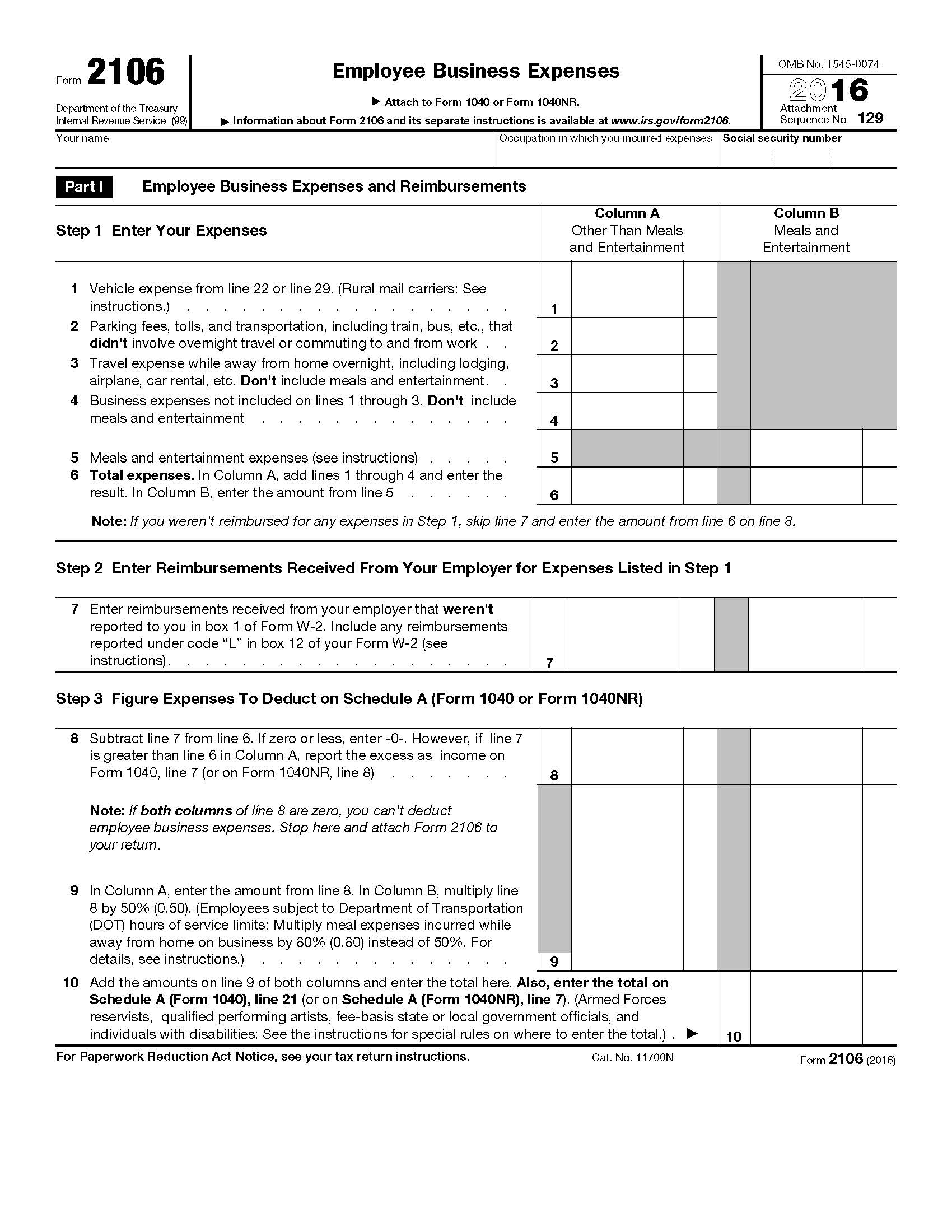

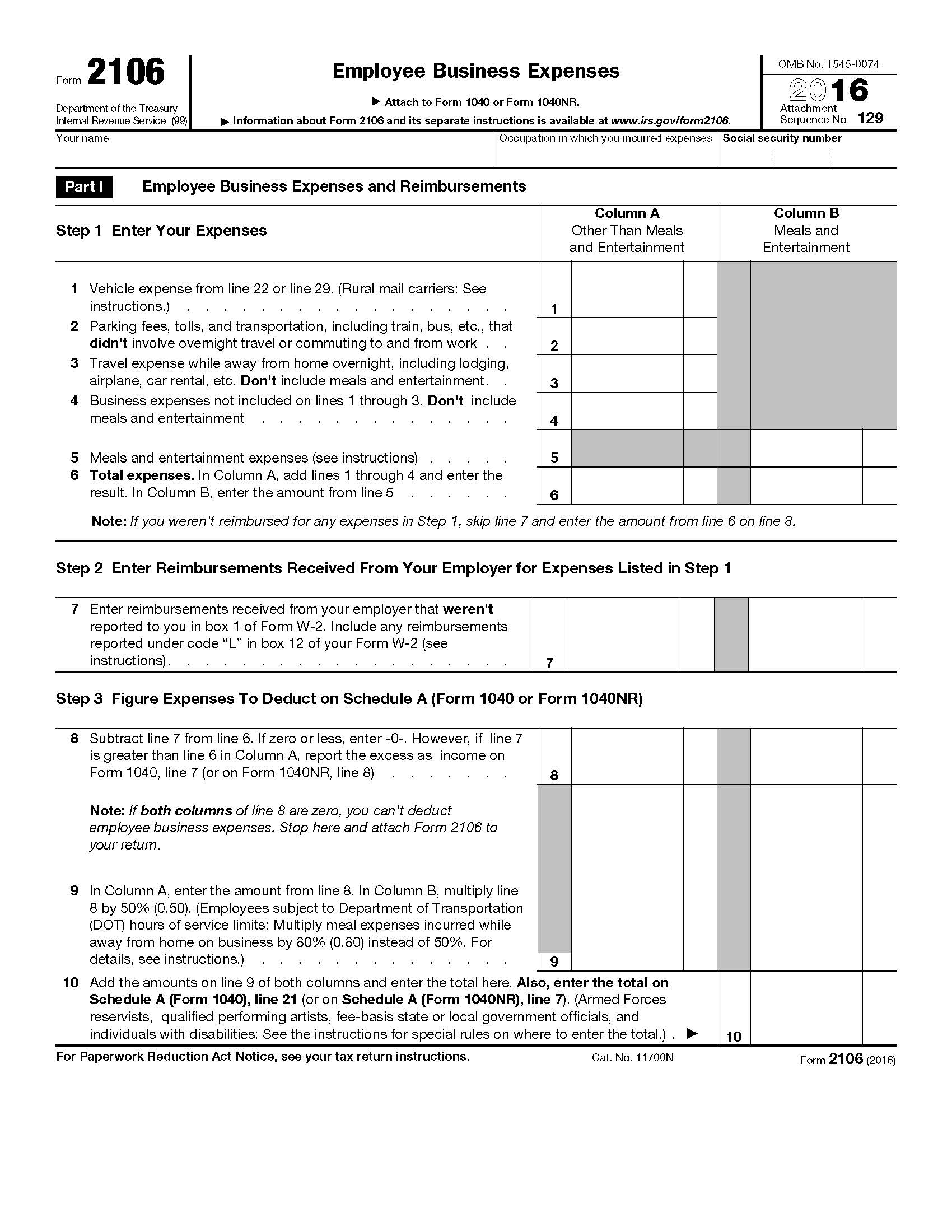

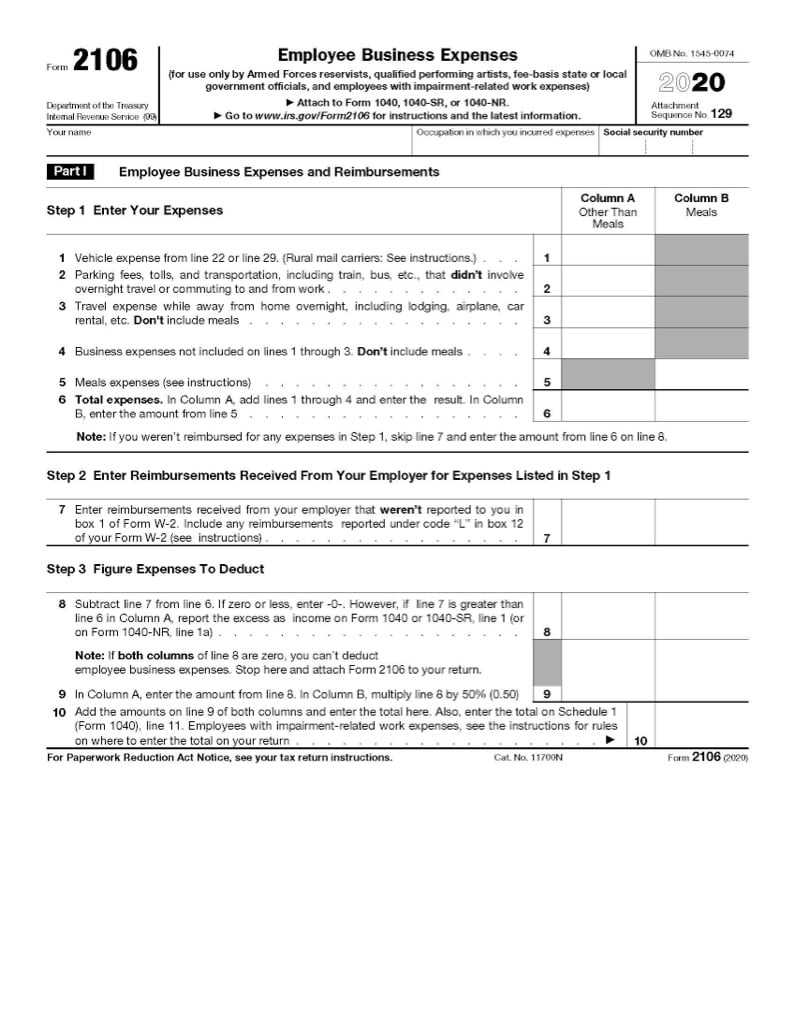

If you are an employee complete Form 2106. If you are a performing artist you may qualify to deduct your employee business expenses as an adjustment to gross income rather than as a miscellaneous itemized deduction.

Election Out Of Qualified Economic Stimulus Propertytaxpay Chegg Com

Travel hotel meals etc vehicle and transportation equipment supplies wardrobe home office expenses legal and professional fees video costs agent fees promotional expenses etc see our list.

Employee business expenses qualified performing artist. Performed services in the performing arts as an em-ployee for at least two employers during the tax year 2. Qualified Performing Artist Deduction. You perform services in the performing arts as an employee for at least two employers.

Performing artist expenses Those who meet the definition of a performing artist can deduct work-related expenses as an adjustment to gross income. Nov 30 2020 Filing IRS Form 2106 with your federal Form 1040 tax return allows you to claim an above-the-line adjustment to income for Employee Business Expenses The deduction is reserved for a few select workers including performing artists who work as employees. If you are a qualified performing artist you can deduct your employee business expenses as an adjustment to in- come rather than as a miscellaneous itemized deduction.

Expenses incurred while a Reservist Performing Artist or Qualifying Government Employee are subject to special deduction rules. Your related performing-arts business expenses are more than 10 of. The amount entered is deductible whether or not you itemize deductions.

Form 2106 is used by employees to deduct ordinary and necessary expenses related to their jobs. No itemizing is required. The allowable expenses must be more than 10 of gross income from the services and the performing artists Adjusted Gross Income for the year cannot exceed 16000 before expenses.

The taxpayer must have worked as a performing artist for at least two employers the amount of the deduction must exceed ten percent of the taxpayers gross income that is attributed to those performances and. A qualified performing artist is one who. Had allowable business expenses attributable to the.

If you are a qualified performing artist you can deduct your employee business expenses as an adjustment to income rather than as a miscellaneous itemized deduction. You are considered a qualifying performing artist if you meet the following requirements. To qualify you must meet all of the following requirements.

No deduction is allowed for certain entertainment expenses membership dues and facilities used. If you are an Armed Forces Reservist you are able to claim a deduction for amounts attributable to travel more than 100 miles away from home. If you are a qualified performing artist you can deduct your employee business expenses as an adjustment to in- come rather than as a miscellaneous itemized deduction.

The performing artist must have performed in the service of at least two employers during the tax year and received at least 200 from each employer. - Received at least 200 in wages from each of the two employers. Received from at least two of the employers wages of 200 or more per employer 3.

You are a qualified per-forming artist if you. The Adjusted Gross Income must be 16000 or less before deducting expenses as a performing artist. Received income of 200 or more per employer for providing services in the performing arts Had qualifying business expenses related to the performing arts of greater than 10 of gross income from the performing arts and Your adjusted gross income was 16000 or less before subtracting expenses as a performing artist.

- Performed services in the performing arts as an employee for at least two employers during the tax year. Performed services in the performing arts as an employee for at least two employers during the tax year. This form is used by Armed Forces reservists qualified performing artists fee-basis state or local.

The performer has a bag of basic expenses that easily fit the above criteria. You receive at least 200 each from any two of these employers. During the tax year you perform services in the performing arts as an employee for at least two employers.

For example musicians and entertainers can deduct the cost of theatrical clothing and accessories that arent suit-. For example musicians and entertainers can deduct the cost of theatrical clothing and accessories that arent suit-. Employees used to have two options for claiming job-related expenses.

To qualify you must meet all of the following requirements. Performing-arts-related business expenses as a qualified performing artist Expenses for performing your job as a fee-basis state or local government official or Impairment-related work expenses as an individual with a disability. For example musicians and entertainers can deduct the cost of theatrical clothing and accessories that arent suitable for everyday wear.

There are certain requirements that first must be met in order to deduct employee business expenses for qualified performing artists on Form 1040. The adjusted gross income of the taxpayer not.

5 Legal Administrative Assistant Resume Templates Pdf Legal Administrative Assistant Administrative Assistant Resume Chronological Resume

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

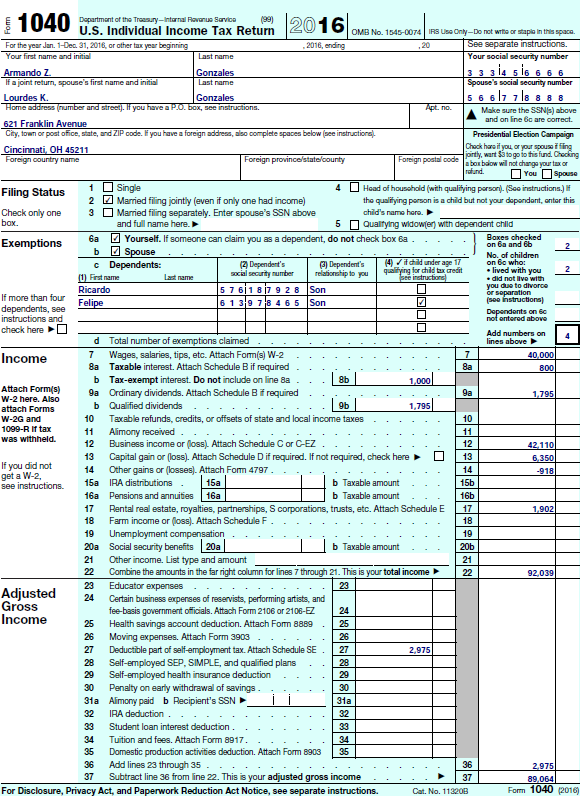

Form 2106 Employee Business Expenses Definition

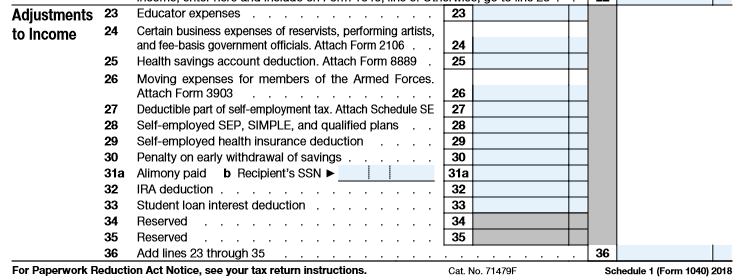

2106 Employee Business Expenses 2106 Schedule1

2018 Tax Act For Creative People

2106 Employee Business Expenses 2106 Schedule1

Instructions For Form 2106 2020 Internal Revenue Service

Medical Procedure Consent Form Template Fresh Medical Procedure Consent Form Template Peterainsworth In 2021 Consent Forms Teacher Resume Template Consent

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Irs Form 2106 Employee Business Expenses Wassman Cpa Services Llc

Https Www 3iscorp Com School Wp Content Uploads Pdf Courses Self Study California Module 3 Study Text Pdf

2018 Tax Act For Creative People

/28374128013_9b6d201c97_k-6dfa7d29e74146d79bf3bf71a3bd544a.jpg)

Form 2106 Employee Business Expenses Definition

1805 030 20 15 Allowable Deductions Dss Manuals

Performing Artists And The Financial Fallout Of The Coronavirus The New Yorker

Fillable W 4 Form How To Fill Out A W 4 Form The Ly Guide You Need Form Example Employee Tax Forms Irs Forms

I Am Sorry I Don T Know What You Mean With Time Chegg Com

Instructions For Form 8995 A 2020 Internal Revenue Service

Form 2106 Claiming Employee Business Expenses

Changes To The Employee Business Expense Deduction Block Advisors

Post a Comment for "Employee Business Expenses Qualified Performing Artist"