The Validity Of Company Valuation Using Discounted Cash Flow Methods

DCF valuation is about making predictions concerning how much future free cash the business will generate and then discounting the future cash flow back into todays money. The paper finds that the discounted cash flow method is a powerful tool to analyze even complex situations.

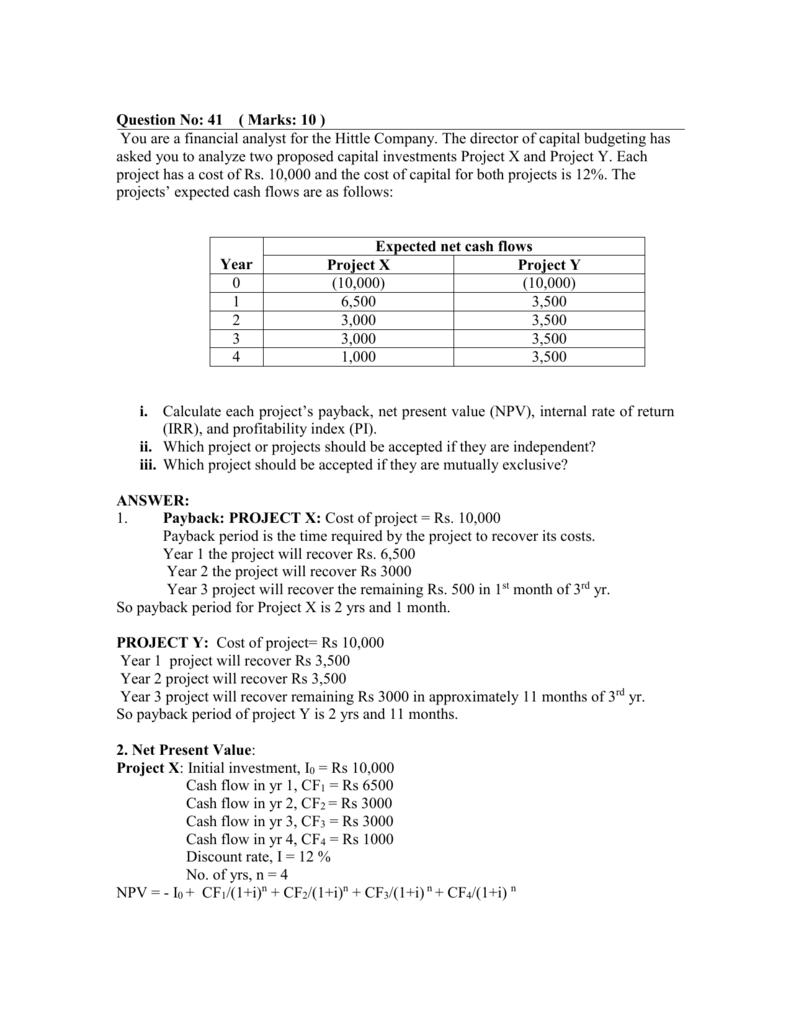

In One Mgt201 Midterm Papers More Than 10 Solved

If the value thus arrived at is higher than the current value of cash invested then it is considered to be a good investment opportunity.

The validity of company valuation using discounted cash flow methods. A special emphasize is being put on the valuation of companies using the DCF method. The Validity of Company Valuation Using Discounted Cash Flow Methods Florian Steiger1 Seminar Paper. However the DCF method is subject to massive assumption bias and even slight changes in the underlying assumptions of an analysis can drastically alter the valuation.

The main objective here is to learn the basic concept. However the DCF method is subject to massive assumption bias and even slight changes in the underlying assumptions of an analysis can drastically alter the valuation. Valuing equity value of a company valuing the entire firm ie.

This paper closely examines theoretical and practical aspects of the widely used discounted cash flows DCF valuation method. The paper finds that the discounted cash flow method is a powerful tool to analyze even complex situations. Even when I value large public companies using a discounted cash flow approach I always do a reality check on multiple of earningsif it seems too high I.

The paper finds that the discounted cash flow method is a powerful tool to analyze even complex. Using a DCF is a method that analysts use throughout finance and some think that using this type of valuation is far too complicated for them. A special emphasize is being put on the valuation of companies using the DCF method.

It assesses its potentials as well as several weaknesses. You will be redirected to the full text document in the repository in a few seconds if not click here. Valuation of a Company Discounted Cash Flow Method The word discounted arises from the concept of time value of money.

A special emphasize is being put on the valuation of companies using the DCF method. It assesses its potentials as well as several weaknesses. A discounted cash flow approach can get complex when done properly and the more complex it is the more likely you can make a mistakepotentially a big and costly mistake which is another reason I prefer a multiple of earnings approach.

The Validity of Company Valuation Using Discounted Cash Flow Methods Florian Steiger1 Seminar Paper Fall 2008 Abstract This paper closely examines theoretical and. Some of the terms used in DCF analysis are as follows. Using a DCF is one of the best ways to calculate the intrinsic value of a company.

Discounted Cash Flow DCF valuation is one of the fundamental models in value investing. View Notes - 10034881 from MBA MBA at ESLSCA. The Validity of Company Valuation Using Discounted Cash Flow Methods - CORE Reader.

We do this so that we. Download Citation The Validity of Company Valuation Using Discounted Cash Flow Methods This paper explores lessons from established financial theory for. It assesses its potentials as well as several weaknesses.

There are three ways of discounting cash flow valuations in general. The Validity of Company Valuation Using Discounted Cash Flow Methods - NASAADS. Once you understand the concept it will be easier to teach yourself and understand how other variations and methods of discounted cash flow analyses work.

We are not allowed to display external PDFs yet. Enterprise value and valuing a firm in pieces ie. This paper closely examines theoretical and practical aspects of the widely used discounted cash flows DCF valuation method.

It assesses its potentials as well as several weaknesses. A special emphasize is being put on the valuation of companies using the DCF method.

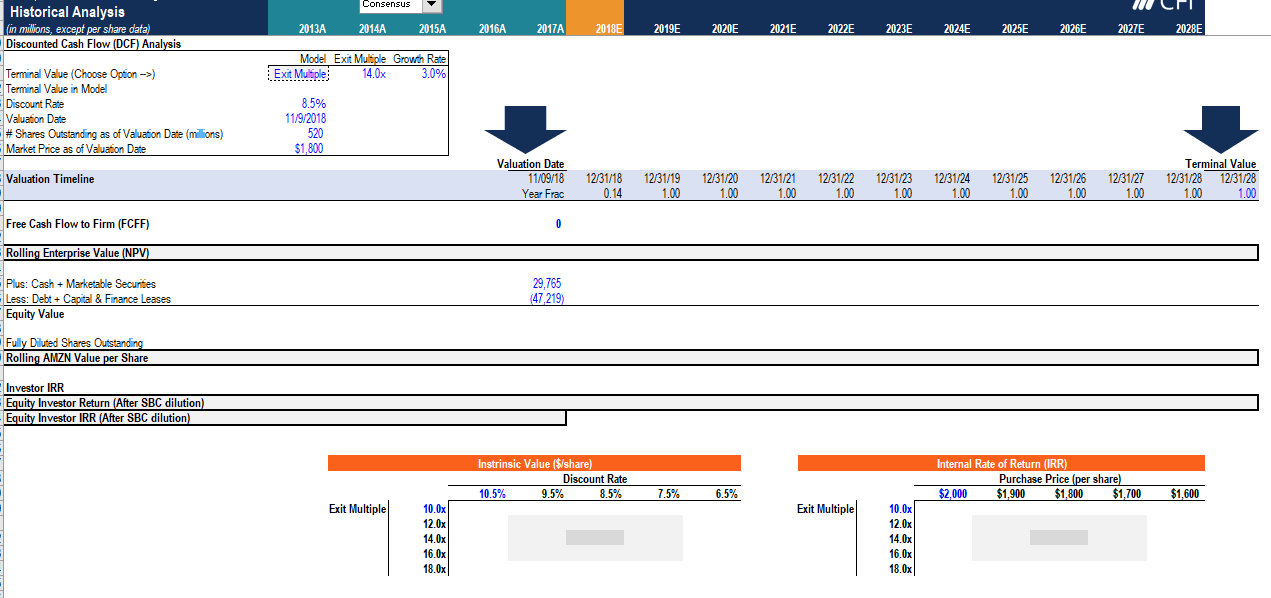

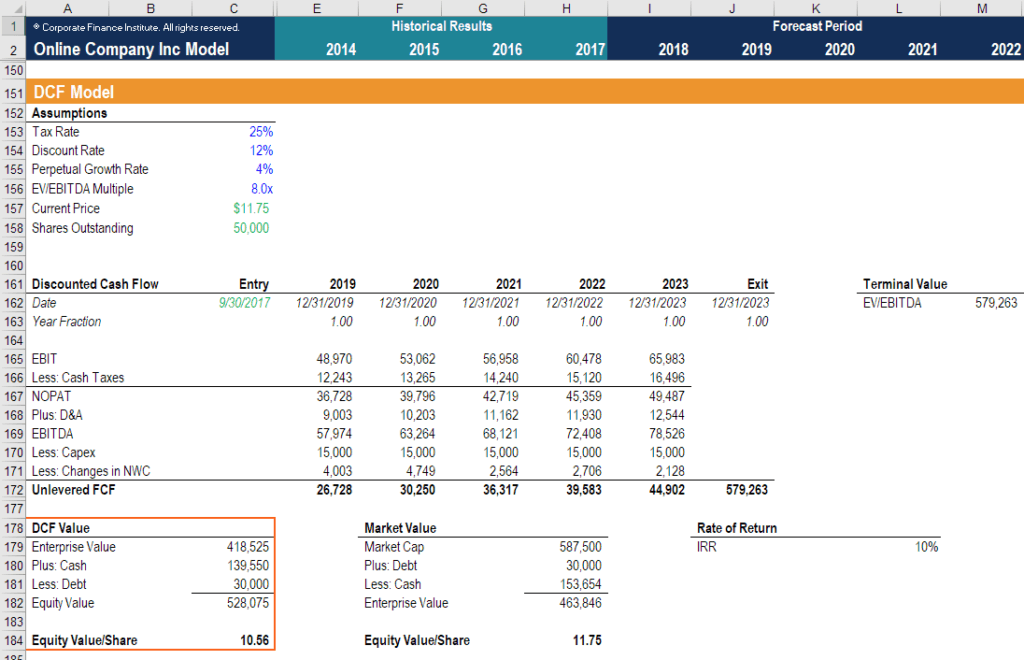

Solved 1 What Is The Exit Multiple Terminal Value On Dec Chegg Com

Dcf Model Discounted Cash Flow Valuation Efinancialmodels Cash Flow Statement Cash Flow Enterprise Value

:max_bytes(150000):strip_icc()/cash_flow-5bfc31ba46e0fb00511acd46.jpg)

Sum Of The Parts Valuation Sotp Definition

What Is The Formula For Calculating Internal Rate Of Return Irr In Excel

Pdf Advantages And Limitations Of The Discounted Cash Flow To Firm Valuation

Discounted Cash Flow Dcf Valuation Model Cash Flow Enterprise Value Investment Tips

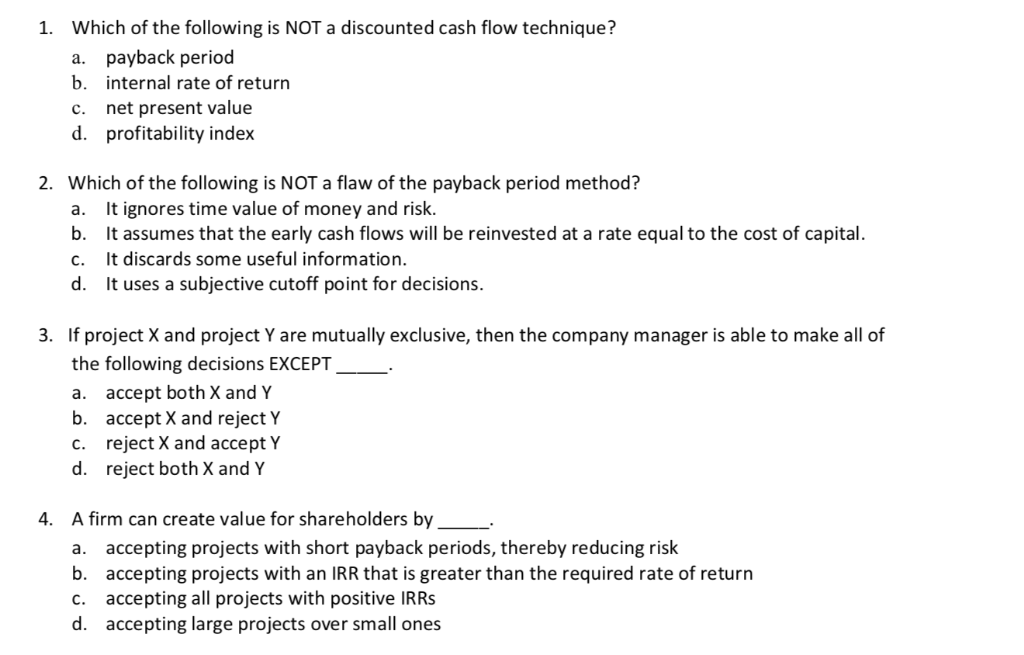

Solved Which Of The Following Is Not A Discounted Cash Fl Chegg Com

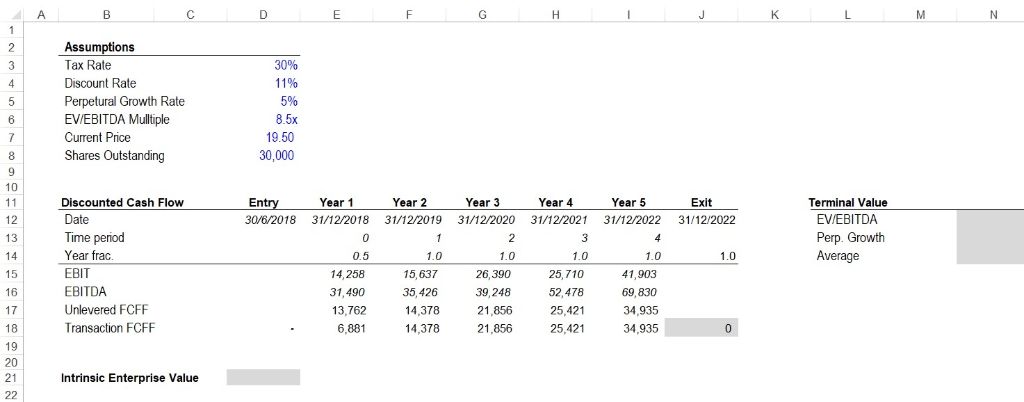

Solved Assumptions Tax Rate Discount Rate Perpetural Grow Chegg Com

Equity Research Part 2 Varsity By Zerodha

Pdf Advantages And Limitations Of The Discounted Cash Flow To Firm Valuation

Enterprise Value Ev Formula Definition And Examples Of Ev

Terminal Value Of The Business Magnimetrics

Pdf Advantages And Limitations Of The Discounted Cash Flow To Firm Valuation

Pdf Valuing Companies By Cash Flow Discounting Ten Methods And Nine Theories

Discounted Cash Flow Dcf Net Present Value Npv

Pdf Valuing Companies By Cash Flow Discounting Ten Methods And Nine Theories

Retail Investor Org How To Pick A Stock Investing Strategy That Suits You Investor Education

Https Cdn Website Editor Net 25dd89c80efb48d88c2c233155dfc479 Files Uploaded Fundamentals 2520of 2520corporate 2520valuation Pdf

Pdf Valuing Companies By Cash Flow Discounting Ten Methods And Nine Theories

Post a Comment for "The Validity Of Company Valuation Using Discounted Cash Flow Methods"