Small Business Administration Bailout Loans

Access our City Chat video to learn more about the Small Business Ecosystem Assessment. COVID-19 EIDL This loan provides economic relief to small businesses and non-profit organizations currently experiencing a temporary loss of revenue.

Everybody Gets A Bailout Which One Is Best For Gym Fitness Business Owners The Fitness Cpa

Continuation of health care benefits rent utilities fixed debt payments.

Small business administration bailout loans. Counting the loan as income. Linda McMahon former Small Business Administration administrator. 7 hours agoThe pandemic she says laid bare key fissures in its small-business resource and financing continuum which in a typical year supports a portfolio of 40 billion in loans.

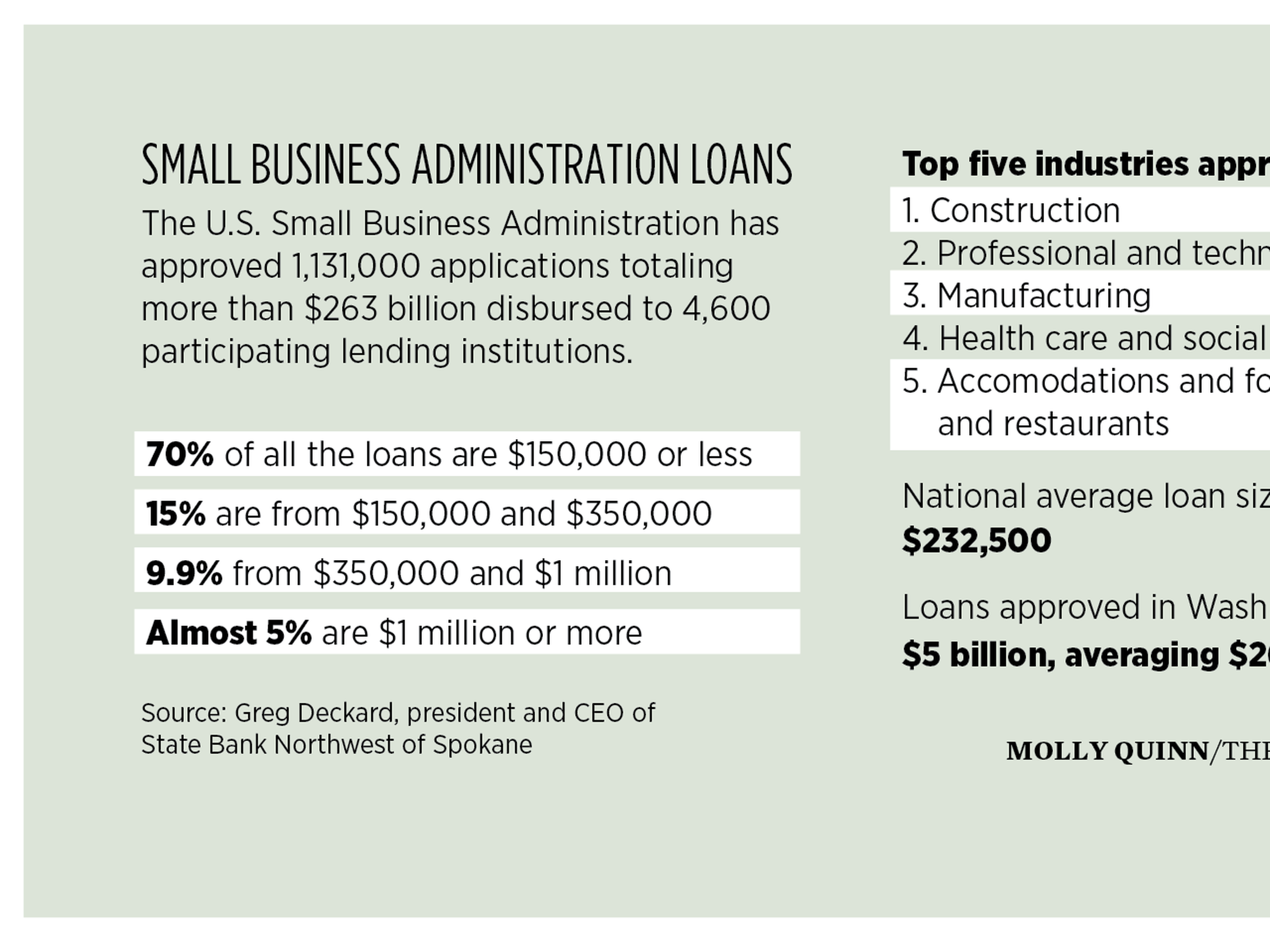

Or if youre looking for a slightly larger loan you might want to consider the SBA 7a loan program. Click here to download the summary. 57 rows As part of the Paycheck Protection Program the federal government has.

WASHINGTON Reuters - US. That makes it easier for small businesses to get loans. Instead it sets guidelines for loans made by its partnering lenders community development organizations and micro-lending institutions.

The Treasury Department and Small Business Administration on Monday disclosed the names of businesses to whom they have lent more than 150000 as. For loans approved starting the week of April 6 2021. Small Business Administration 409 3rd St SW.

The SBA reduces risk for lenders and makes it easier for them to access capital. Small Business Ecosystem Assessment The City of Columbus partnered with Next Street and Development Strategies to assess the small business ecosystem in Columbus in order to identify gaps and opportunities for supporting a thriving and inclusive ecosystem. According to Businessgov a web site managed by the United States Small Business Administration the federal government does not provide grants for starting a business.

SBA guaranteed business loans. 2 days agoWhen Congress passed the second coronavirus bailout at the end of 2020 it specifically allowed for such deductions. Treasury Secretary Steven Mnuchin said he was pressing ahead with the Friday launch of a 349 billion coronavirus rescue loan program for small businesses.

The governments small business loan program to shore up Main Street goes public on Friday. Who advises small business clients. SBA 7a loans and other loans guaranteed by the Small Business Administration SBA dont provide funds to business owners directly.

Ohio SBA Business Loan. For loans approved prior to the week of April 6 2021 see loan increases. A new report from the inspector general for the Small Business Administration finds that forgivable loans from the government intended to help small businesses weather the.

Apply for a low-interest disaster loan to help recover from declared disasters. 24-months of economic injury with a maximum loan amount of 500000. The agency doesnt lend money directly to small business owners.

The SBA works with lenders to provide loans to small businesses. Find an SBA lender near you to help fund your business. However the web site further reveals that they do provide some financial support that makes it easier for small business owners to obtain low-interest loans and venture.

According to the Small Business Administration SBA the federal government has allotted 730 billion for that organization to assist small-business owners in keeping their companies afloat. Home business disaster loans. Ohio Small Business Awarded SBAs National Tibbetts Award for Innovative Research March 5 2021 SBAs Great Lakes Region Has Nearly 308000 Loans Totaling 228 Billion Approved in Paycheck Protection Programs.

This funding is primarily available for the SBA to insure or underwrite loans for small businesses. Instead the SBA guarantees the funds in case of default up to a certain limit.

Us Government Refuses To Say Which Small Businesses Received Ppp Loans

Everybody Hates The Sba The American Prospect

Fact Check Biden Says Small Business Missed Out On 40 Of Bailout Funds Wral Com

Sba Sets Up 14 Day Exclusive Loan Period For Small Biz Changes To Ppp

Sba Overwhelmed May Cause Delay In Smb Loans Pymnts Com

Federal Coronavirus Bailout Program Is Frustrating And Disappointing For Some Small Business Owners Kcet

Washington Post Other News Organizations Are Suing The Small Business Administration For Access To Coronavirus Loan Data The Washington Post

Former Sba Administrator Explains How The Small Business Bail Out Will Work

Spokane Bankers Face Growing Questions About Sba Loan Rules The Spokesman Review

Sba Grant Program Attracting The Wrong Kind Of Attention The Washington Post

Are Coronavirus Small Business Administration Loans Available For Businesses Like Mcdonald S Fox Business

Scammers Targeting Small Businesses By Submitting Fraudulent Loan Information

Here S The 411 On Sba Disaster Loans Ppp Program Webinars To Guide You Through The Process Mill Valley Chamber Of Commerce Visitor Center

Sba Paycheck Protection Program Approved Loans Per Capita State Map

Sba Official Blasts Big Banks Over Failure To Quickly Distribute Loans To Businesses The Seattle Times

Small Business Rescue Program Runs Out Of Money Amid Political Standoff Abc News

Small Business Administration Sba Loans Immediately Available To Child Care Providers First Five Years Fund

Why Small Business Rescue Loans Are Hard To Get Barron S

Small Business Bailout Needs More Than Banks Wsj

Post a Comment for "Small Business Administration Bailout Loans"