Can You Write Off Unreimbursed Business Expenses In 2019

If you were an employee who was used to deducting your unreimbursed employee business expenses EBE you might have been unpleasantly surprised while preparing your 2018 federal tax return when you realized this deduction had gone away. The educator expense deduction marks one of the few unreimbursed employee expenses that taxpayers can still deduct on their returns.

Unreimbursed Business Expenses And How It Affects Mortgage Process

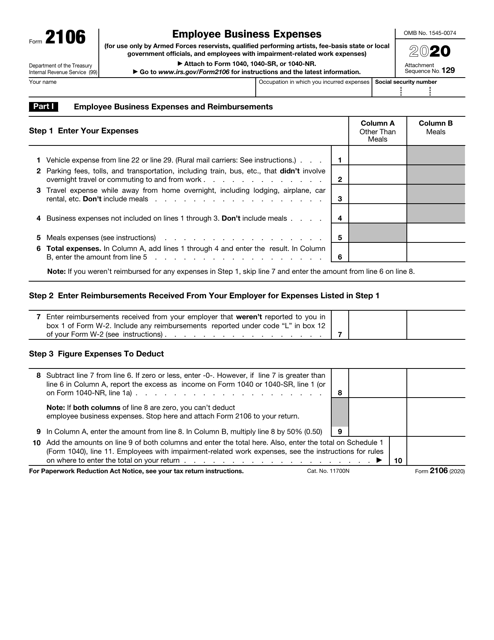

Business expenses for Armed Forces reservists are deducted on Form 2106 Employee Business Expenses.

Can you write off unreimbursed business expenses in 2019. The TCJA eliminated all deductions for unreimbursed employee expenses for 2018 through 2025. We all know that most churches dont have a lot of extra money floating around. December 23 2019 by Carolyn Richardson EA MBA.

That why now is a great time to bring the subject up to your employer so. But if you have unreimbursed business expenses as an employee what used to be known as Employee Business Expenses EBE then those expenses are generally no longer deductible for the 2019 tax year on your federal tax return. If you are using actual expenses to figure your deduction for the business use of your home use.

Before this change these expenses were deductible as a miscellaneous itemized deduction on Form 1040 Schedule A. There are three criteria that must be true in order to deduct unreimbursed employee expenses. However with tax reform all miscellaneous 2 expenses including unreimbursed employee expenses are not allowed between 2018 and 2025.

It must be directly related to your job and it should be common and necessary to your line of work. In fact they were not deductible in 2018 and will not be deductible through 2025. You may be allowed to deduct unreimbursed ordinary and necessary expenses you paid on behalf of the partnership including qualified expenses for the business use of your home if you were required to pay these expenses under the partnership agreement and they are trade or business expenses under section 162.

These expenses if not subject to reimbursement from the corporation are unreimbursed employee business expenses treated as miscellaneous itemized deductions subject to the 2 of. You can deduct unreimbursed partnership expenses UPE if you were required to pay partnership expenses personally under the partnership agreement. To determine if the taxpayer has incurred any of these expenses it is important to ask probing questions during the taxpayer interview.

Business expenses qualifying moves allowances and reimbursements and deductible moving expenses. You cant claim the deduction if any of these circumstances apply. Your employer can still deduct all qualified employee expense reimbursements.

By Amy Monday February 11 2019 While pastors can no longer deduct unreimbursed business expenses on Schedule A they can subtract them from their taxable income on Schedule SE. They didnt give you an advance toward these costs or an allowance to pay for them. Make sure your employer hasnt paid you back for what you spent.

For many employees this ability to deduct employment-related expenses that were not. Review the instructions beginning on Page 25 of the PA-40IN to determine if you can deduct expenses from your PA-taxable compensation. The expense must be paid during the tax year you are filing.

For an expense to be ordinary it must be accepted in your job. Expenses such as union dues work-related business travel or professional organization dues are no longer deductible even if the employee can itemize deductions. S corporation shareholders generally cannot deduct unreimbursed business expenses on Schedule E because the shareholders are categorized as employees when performing services for the corporation.

Dont include any expenses you can deduct as an itemized deduction. Unreimbursed moving expenses are deducted using Form 3903 Moving Expenses. Eligibility for the Employee Business Expense Deduction Unreimbursed is the key word here.

Employee ministers should seek to have their work-related expenses. If you have a lot of unreimbursed job expenses the first thing you may want to do is see if your employer will cover the cost. Dont combine these expenses with or net them against any other amounts from the partnership.

You can claim a deduction for an unreimbursed employee business expense by filing a PA Schedule UE Allowable Employee Business Expenses form along with your PA-40 Personal Income Tax Return. You can deduct unreimbursed employee expenses only if you qualify as an Armed Forces reservist a qualified performing artist a fee-basis state or local government official or an employee with impairment-related work expenses. A teacher instructor counselor principal or aide who teaches.

Can I Deduct Work Expenses In 2019 In 2020

Employee Paid Business Expenses The Cpa Journal

Unreimbursed Business Expenses And How It Affects Mortgage Process

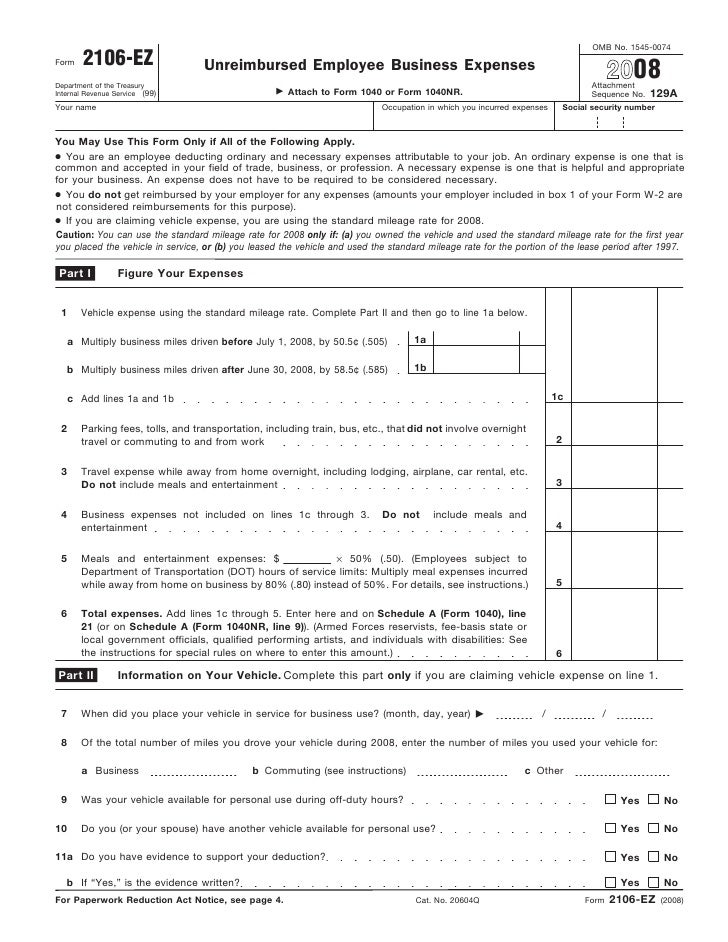

Form 2106ez Unreimbursed Employee Business Expenses

Instructions For Form 8995 2019 Internal Revenue Service Internal Revenue Service Federal Income Tax Business Card Design

I Pinimg Com Originals 8c 72 D1 8c72d1cb1a836c2

How The New Tax Law Affects Unreimbursed Business Expenses For Pastors The Pastor S Wallet

Can I Deduct Unreimbursed Job Expenses The Official Blog Of Taxslayer

Deducting Unreimbursed Employee Business Expenses Back Alley Taxes

Schedule C Tax Rates Org The 2019 Tax Resource

Can I Deduct Unreimbursed Employee Business Expenses In 2019

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Re On 2020 Home Business Software Tt Does Not

Employers Irs Updates Business Travel Per Diems

Irs Form 2106 Download Fillable Pdf Or Fill Online Employee Business Expenses 2020 Templateroller

Irs Form 2106 Download Fillable Pdf Or Fill Online Employee Business Expenses 2020 Templateroller

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

How Pastors Church Employees Can Get A Tax Break For Their Unreimbursed Business Expenses The Pastor S Wallet

Unreimbursed Business Expenses And How It Affects Mortgage Process

Post a Comment for "Can You Write Off Unreimbursed Business Expenses In 2019"