K1 Ordinary Business Loss

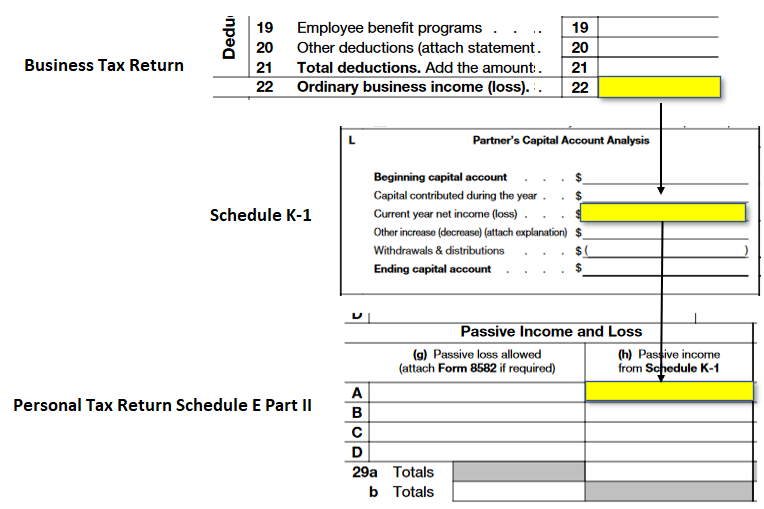

Line 1 - Ordinary IncomeLoss from Trade or Business Activities - Ordinary business income loss reported in Box 1 of the K-1 is entered as either Non-Passive IncomeLoss or as Passive IncomeLoss. That makes the income passive and.

1065 Partner Special Allocations

Cash contribution 1179.

K1 ordinary business loss. They dont directly benefit you. My ordinary business loss on my K-1 is not showing up on my federal return - why not. If your K-1 shows a net loss you report it on the appropriate tax schedule for example Schedule E for a.

That happens when you got to the K-1 entry screen Did You Participate. Did you materially participate in this activity. You clicked the No button there is a Learn More link there that explains about material participation.

Several factors determine whether the income is considered Passive or Non-Passive including whether the taxpayer was a general or limited partner in the entity and their actual participation in the. Capital losses are more limited. Evaluate basis At-Risk rules Passive activity.

Special Cases for Reporting Schedule K-1 on Form 1040 In most cases ordinary pass-through income or loss from a partnership LLC or S corporation goes on Schedule E Line 28. Loss class under section 704 d. In addition to being the entry field for Ordinary Income Loss from Trade or Business Activities that is reported on Box 1 of the K-1 this field is used to make other entries that are reported to the taxpayer on a Schedule K-1 Form 1120-S which should flow through to Schedule E.

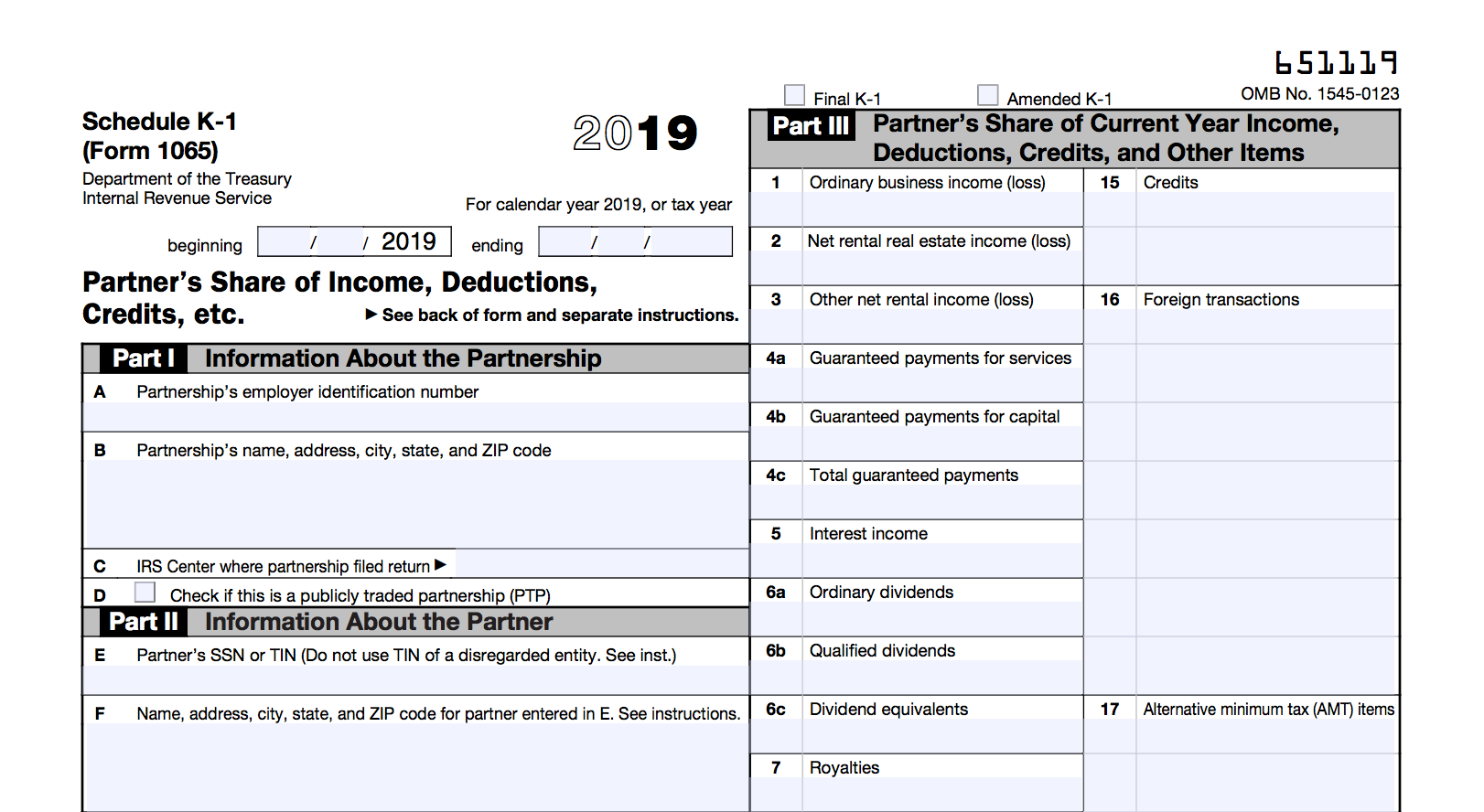

Ordinary Business Income Loss The amount reported in box 1 is your share of the ordinary income loss from trade or business activities of the corporation. Schedule K-1 is a schedule of IRS Form 1065 that members of a business partnership use to report their share of a partnerships profits losses deductions and credits to the IRS. If your deductions are greater than your income you need to do further.

Cash contribution 1130. Regulations section 1163 j-6 h created a new section 704 d loss class for business interest expense effective for tax years beginning after November 12 2020 for purposes of loss limitation. See Decedents Schedule K-1 below.

For example if an investment in a PTP has an ordinary loss on line 1 and an equal amount of interest income on line 5 of Schedule K-1 the loss is a. Calculating an NOL gets complicated. However you use IRS Schedule K-1 to report your losses.

Schedule K -1 Box 1 Ordinary business income loss Income Schedule E page 2 Material participation rules for passive or non-passive Schedule SE for an active business Loss is it deductible. The first of these limitations is the basis limitation which limits the losses and deductions to the adjusted basis in the activity at year-end. Total loss to Carryforward 87941.

Partners and shareholders of S-Corporations are subject to three separate limitations on the losses and deductions reported to them on Schedule K-1. Income or Loss Reported on IRS Form 1065 or IRS Form 1120S Schedule K-1 The version of Schedule K-1 that is utilized to report a borrowers share of income or loss is based on how the business reports earnings for tax purposes. If youre the shareholder in a C corporation the corporation deducts any losses not the shareholders.

However if the earnings were paid in the form of dividends or interest then you report them on Schedule B. Current year loss. You can subtract any ordinary losses from the profit your business made to reduce your taxable income.

Total Allowed Loss 90365. Generally where you report this amount on Form 1040 or 1040-SR depends on whether the amount is. Youll fill out Schedule K-1 as part of your Partnership Tax Return Form 1065 which reports your partnerships total net income.

Ordinary losses are generally considered preferable to capital losses because they can be used to offset your other sources of income. Business losses pass through the business to the owners individual tax returns. Any amount of loss and deduction in excess of the adjusted basis at the end of the year is disallowed in the current year and.

Ordinary business loss 86811. Code N box 20. Partnership reported on IRS Form 1065 Schedule K-1.

Click to see full answer. Because partnerships are so-called pass-through entitiesthey let the profits or losses. Can You Deduct K-1 Business Losses Personal Money You Put Into the Business.

Ordinary business loss 86811.

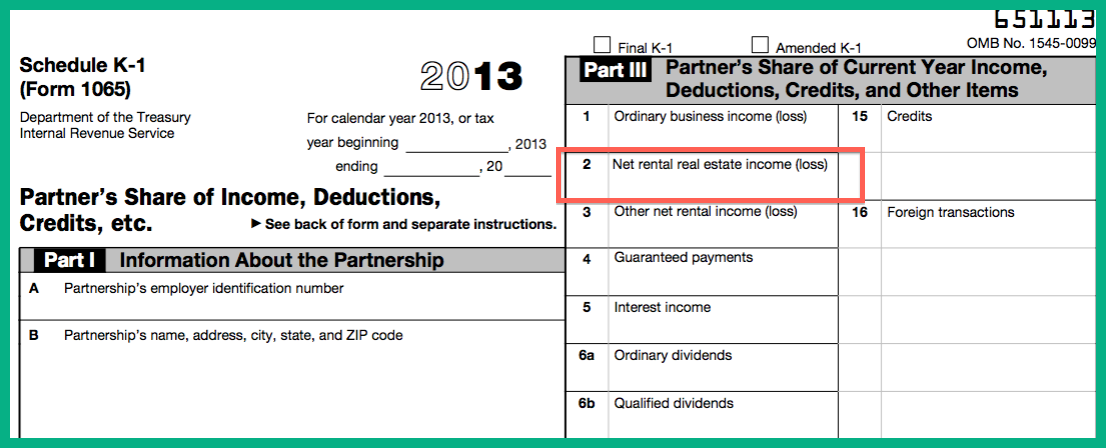

Understanding Your Schedule K 1 And Real Estate Taxes Crowdstreet

Https Www Irs Gov Pub Irs Utl 2017ntf Dealingpartnershipk1 Pdf

A Small Business Guide To The Schedule K 1 Tax Form The Blueprint

Https New Content Mortgageinsurance Genworth Com Documents Training Course Partnershipincome1065formk1 Presentation 0420 Pdf

What Is A Schedule K 1 Form Zipbooks

Reporting Publicly Traded Partnership Sec 751 Ordinary Income And Other Challenges

3 Ways To Fill Out And File A Schedule K 1 Wikihow

What Is A Schedule K 1 Form Zipbooks

3 Ways To Fill Out And File A Schedule K 1 Wikihow

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

Choose One Of The Partners Murray Or Parker And Chegg Com

3 0 101 Schedule K 1 Processing Internal Revenue Service

Irs Form 1065 Schedule K 1 2020

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

What Is A Schedule K 1 Form Zipbooks

Linda Keith Cpa All About The 8825

3 Ways To Fill Out And File A Schedule K 1 Wikihow

Post a Comment for "K1 Ordinary Business Loss"